Why Picking the Right Bookkeeping Service MattersFor many small business owners, bookkeeping feels like a necessary chore — essential, yet far from exciting. But here’s the truth: the quality of your bookkeeping can make or break your business. Your financial records are the heartbeat of your company — showing where your money is going, what’s driving profit, and how sustainable your growth really is. A skilled bookkeeping service doesn’t just record transactions; it gives you the clarity and confidence to make better business decisions every single day. Unfortunately, many small businesses learn this lesson the hard way. They hire the cheapest provider available, or try to do everything themselves, only to discover:

Choosing the right bookkeeping service is therefore not just a financial decision — it’s a strategic partnership. The right provider will help you:

What This Guide Will Help You DoThis guide will walk you step-by-step through how to:

Whether you’re a U.S.-based startup or an international entrepreneur expanding into the U.S. market, this article will help you find the bookkeeping service that fits your size, goals, and budget — without the overwhelm. 💡 If you’re looking for professional bookkeeping that’s tailored to your business, talk to Confido — we help small businesses stay compliant, organized, and growth-ready with precision bookkeeping and financial insights.

| ||||||||||||||||||||||||

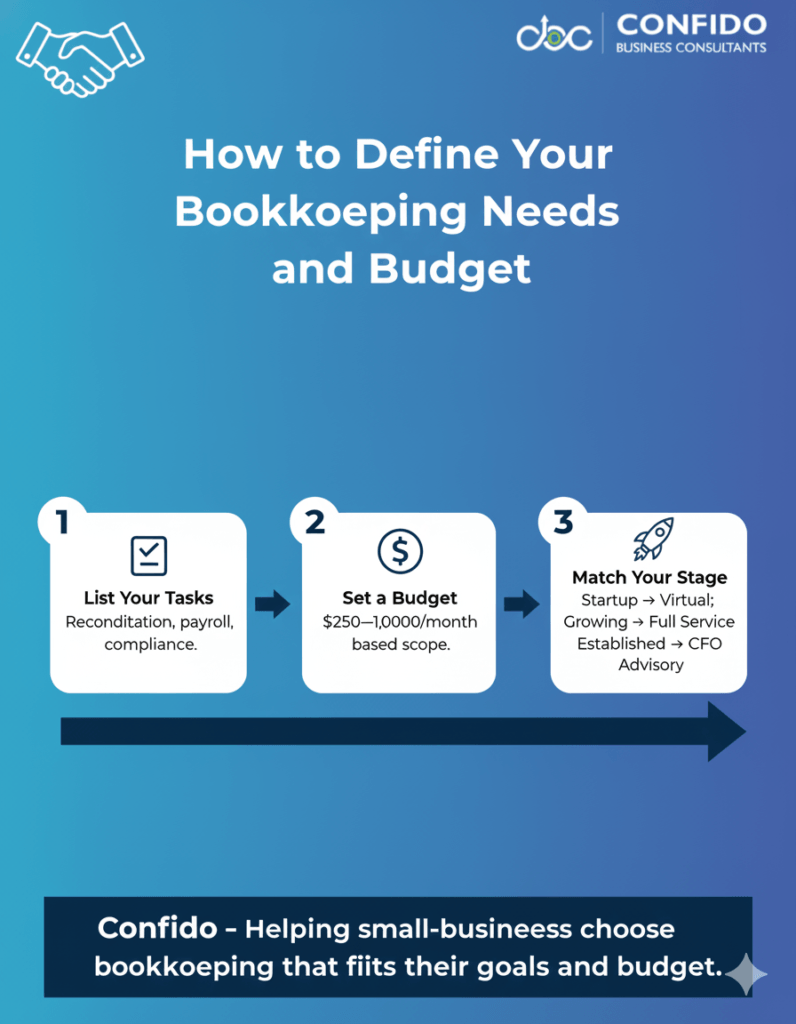

Define Your Needs & Budget – What Your Business Requires and What You’re Willing to PayBefore you start comparing bookkeeping services, take a step back and define what your business truly needs. The “best” bookkeeping service isn’t the one with the most features — it’s the one that aligns perfectly with your business model, transaction volume, and growth goals. A clear understanding of your needs and budget not only narrows your search but also helps you communicate expectations to potential providers — and ensures you get maximum ROI from your investment. Step 1: Identify Your Bookkeeping RequirementsStart by listing what you want your bookkeeper to handle. Bookkeeping services can range from basic transaction recording to full-scale financial management. Common bookkeeping needs for small businesses include:

If your business operates internationally or deals with multiple currencies, you may also need multi-currency bookkeeping or compliance with U.S. GAAP or IFRS standards. 💡 Pro Tip: Step 2: Estimate Your BudgetBookkeeping services vary widely in cost depending on complexity, industry, and the provider’s experience level. Here’s a general benchmark for small businesses:

When setting your budget:

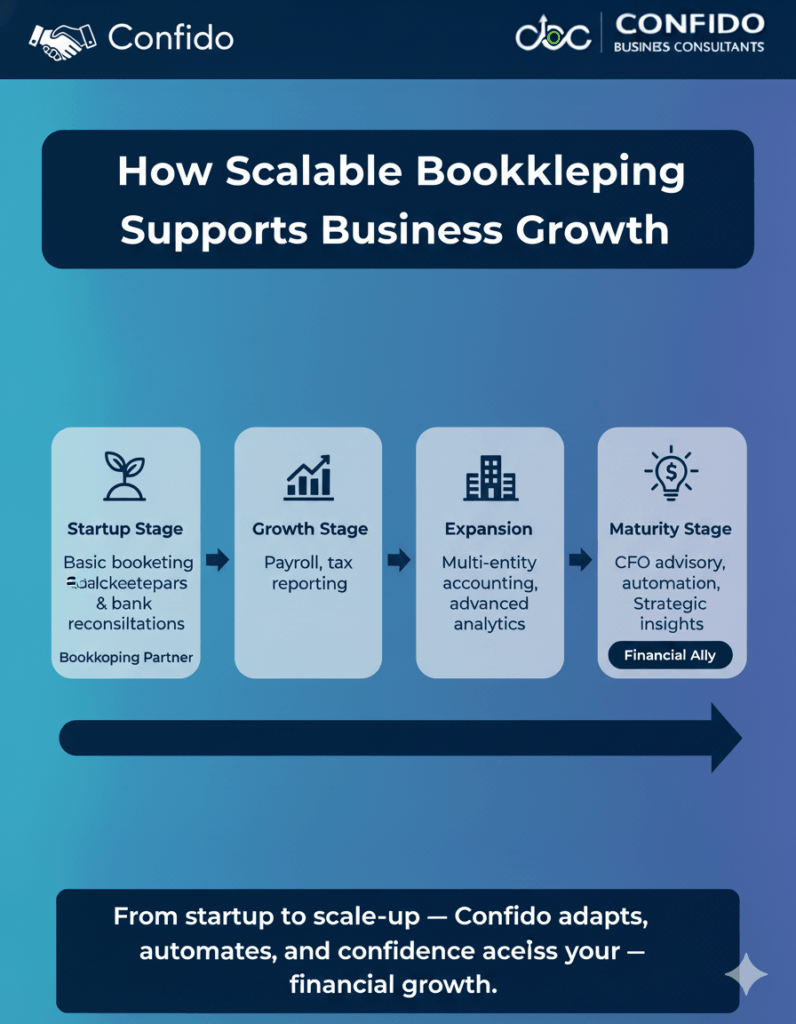

Step 3: Match Needs with Business StageYour bookkeeping needs will depend heavily on your stage of growth:

💡 Not sure what level of bookkeeping your business really needs? Talk to Confido — we’ll assess your current systems, recommend the right plan, and help you grow with clarity and confidence.

| ||||||||||||||||||||||||

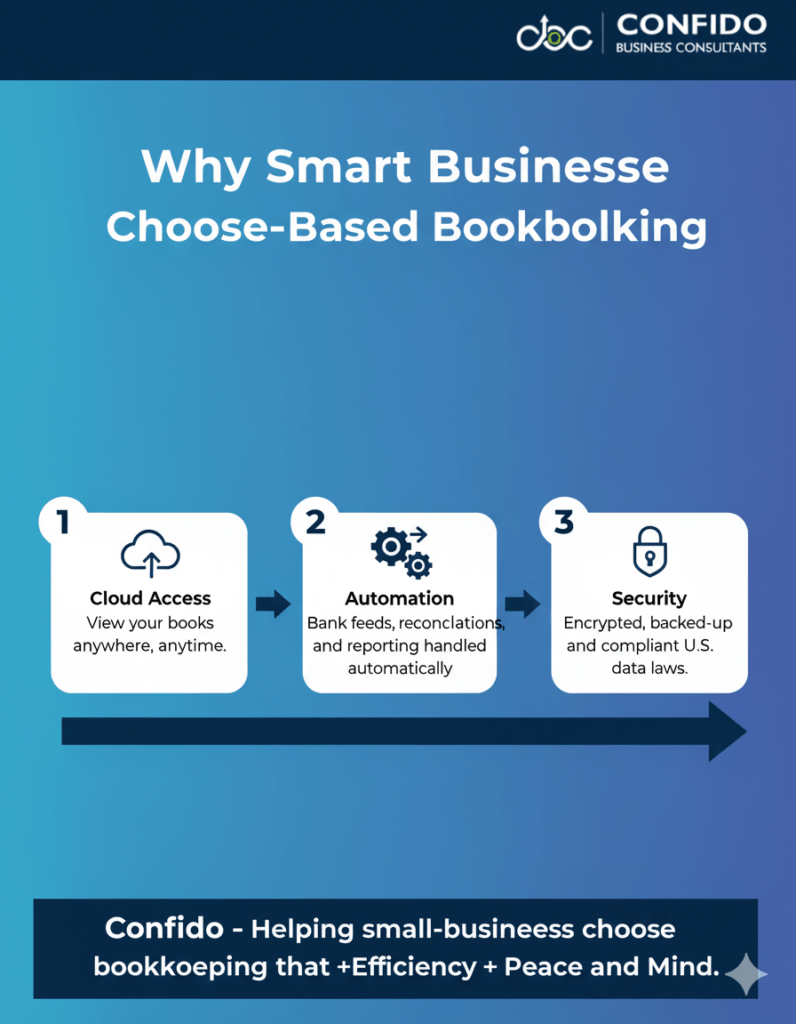

Software Compatibility & Technology – Should You Choose a Provider Using QuickBooks, Cloud Bookkeeping, Integrations?Modern bookkeeping is powered by technology — not spreadsheets. The software your bookkeeping provider uses determines how accurate, efficient, and transparent your financial management will be. The right tools also save you from endless email chains, data entry errors, and missing receipts. Today, small businesses expect real-time financial insights and easy collaboration, which is only possible with secure, cloud-based bookkeeping systems. Step 1: Choose Cloud-Based Bookkeeping for AccessibilityCloud bookkeeping software like QuickBooks Online, Xero, or FreshBooks allows both you and your bookkeeper to:

Cloud systems eliminate manual updates and make collaboration seamless. You can log in, view cash-flow dashboards, and approve expenses in real time — no need to email Excel sheets back and forth. 💡 Pro Tip: Step 2: Ensure Compatibility with Your Existing ToolsBefore choosing a provider, confirm whether their tech stack integrates smoothly with yours.

…your bookkeeping service should be able to connect and automate data flow across these platforms. This not only reduces manual work but also prevents errors caused by duplicate entries or mismatched records. Ask your provider:

Step 3: Prioritize Data Security and AutomationFinancial data is sensitive — and protecting it is non-negotiable. Choose a bookkeeping provider that:

Automation doesn’t just save time — it enhances accuracy and ensures your books are always up to date. 💡 Confido combines the power of QuickBooks Online with advanced automation and integrations that streamline your financial processes. Talk to us to modernize your bookkeeping and gain real-time visibility into your business performance.

| ||||||||||||||||||||||||

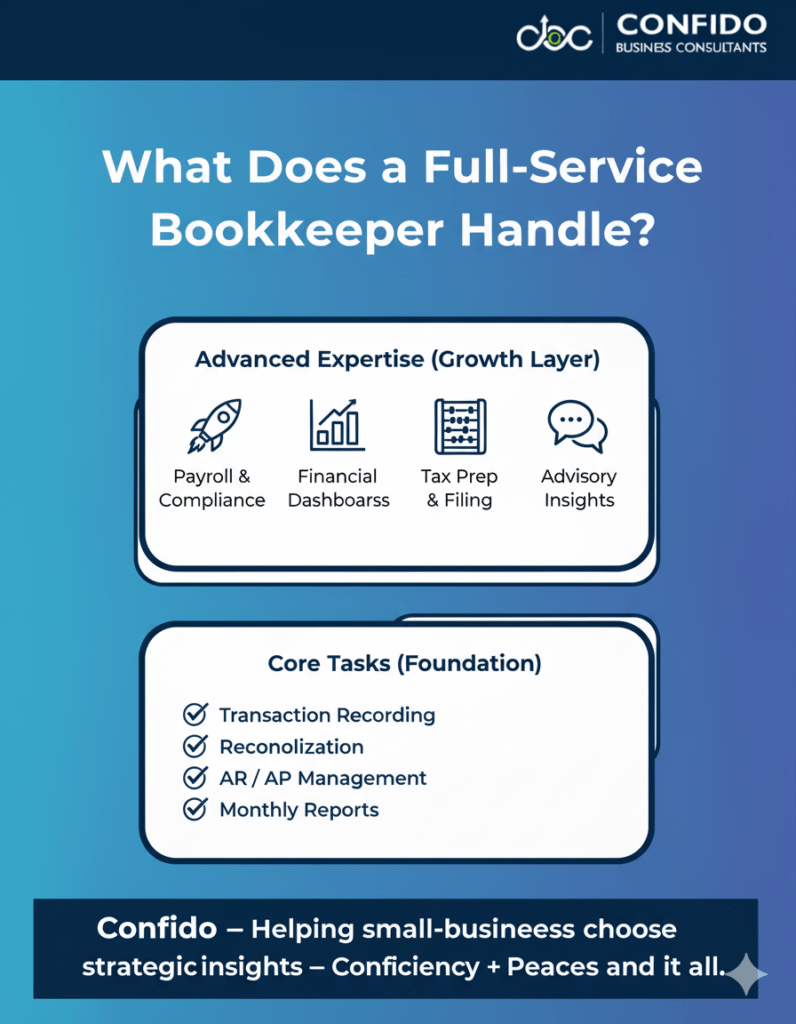

Service Scope & Expertise – What Tasks They Cover: Payroll, Tax Prep, Reconciliation, ReportsNot all bookkeeping services are created equal. Some handle only basic data entry; others act as an extension of your finance team, managing everything from payroll to tax compliance. Understanding exactly what’s included (and what’s not) will help you choose the provider that fits your business goals — and prevents you from paying for tasks you’ll still end up doing yourself. Step 1: Know the Core Bookkeeping TasksEvery reliable bookkeeping service should at least manage these fundamental tasks:

These basics form the foundation of clean, audit-ready books — essential for accurate decision-making and tax filings. Step 2: Look for Value-Added ExpertiseBeyond the basics, leading bookkeeping providers offer specialized services that deliver strategic financial clarity, not just compliance:

A provider that offers these advanced capabilities becomes not just a vendor, but a strategic partner who understands how your financial operations drive business growth. Step 3: Ask About Industry ExperienceBookkeeping is not one-size-fits-all. A retail company’s bookkeeping needs differ from those of a SaaS startup or a consulting firm.

Providers who understand your business type can spot inefficiencies faster and provide benchmarking insights you wouldn’t get elsewhere. 💡 At Confido, we go beyond transaction tracking — we deliver insight-driven bookkeeping for small businesses and founders who want clarity, compliance, and confidence. Talk to our team to learn how our tailored bookkeeping solutions can transform your financial operations.

| ||||||||||||||||||||||||

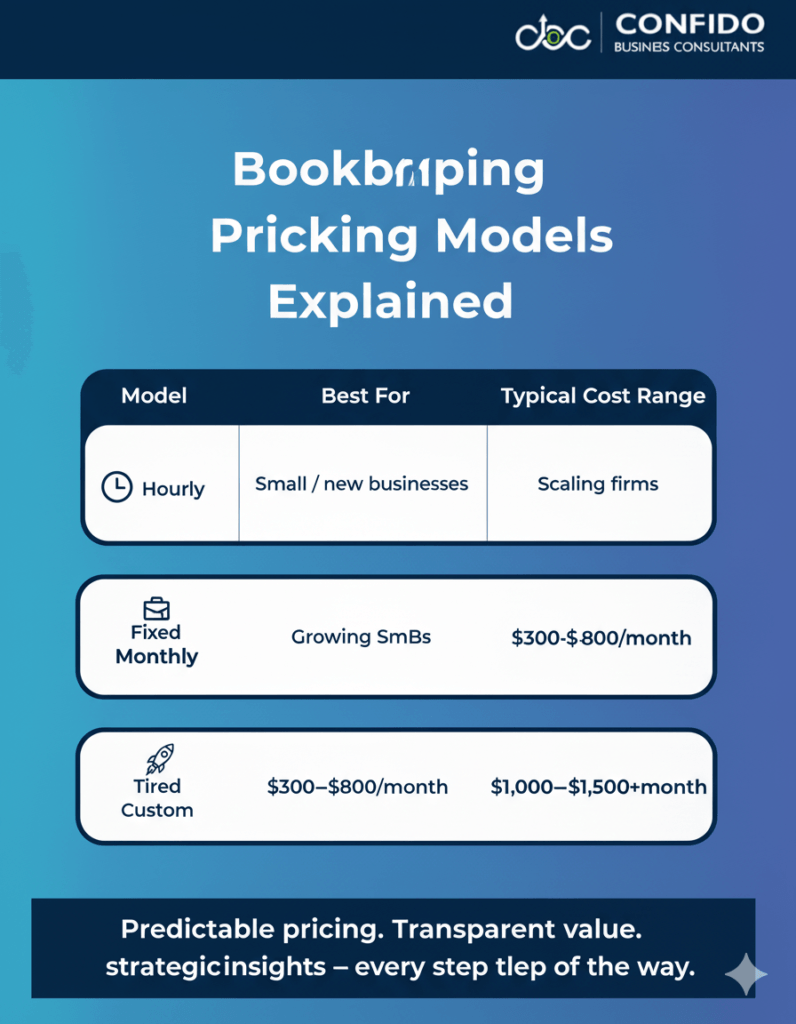

Pricing Models & Cost Transparency – Fixed vs Hourly vs Monthly Packages; What Small Businesses Typically PayWhen it comes to bookkeeping, pricing can often feel like a black box — unclear, inconsistent, and full of hidden costs. But transparent pricing isn’t just a “nice-to-have.” It’s a signal of a bookkeeping provider’s integrity, professionalism, and confidence in their process. Before signing any agreement, it’s crucial to understand how bookkeeping pricing works, what you’re paying for, and what level of service you can expect in return. Step 1: The Common Pricing ModelsBookkeeping providers typically follow one of three pricing models. Each has its pros and cons depending on your business stage and complexity. 1. Hourly PricingYou’re charged based on the actual time spent managing your books. ✅ Best for: New or very small businesses with low transaction volume. Example: A bookkeeper charging $40–$70/hour may take 8–12 hours per month for basic bookkeeping — costing $320–$840 monthly. 2. Fixed Monthly PackagesA flat monthly fee that covers a defined set of tasks — such as reconciliation, reporting, and compliance filings. ✅ Best for: Businesses seeking predictable costs and clear deliverables. Example: Small business packages typically range from $300–$800/month, depending on transaction volume, software integrations, and service scope. 3. Tiered or Custom PackagesTailored pricing that adjusts as your business grows — often bundled with payroll, CFO advisory, or automation tools. ✅ Best for: Growth-oriented businesses that want scalability and long-term partnership. Example: A hybrid bookkeeping + CFO advisory plan may start around $1,000–$1,500/month for comprehensive financial management. Step 2: Factors That Influence PricingThe cost of bookkeeping services depends on:

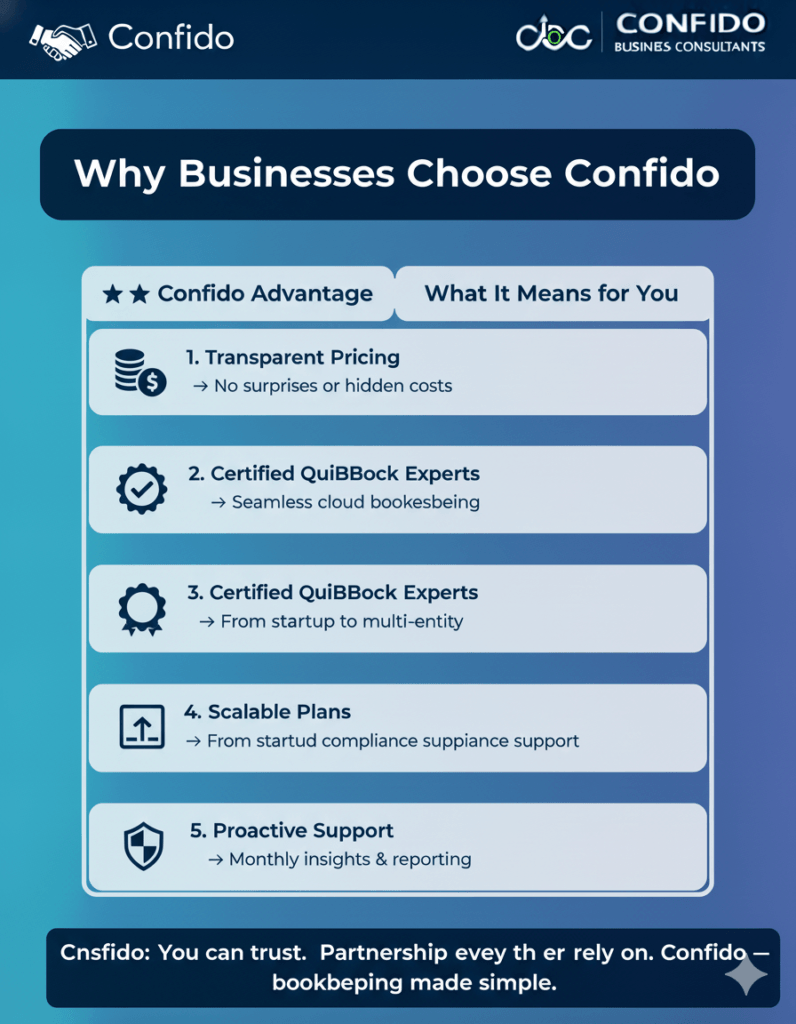

💡 Pro Tip: Step 3: Look for Cost TransparencyA trustworthy bookkeeping partner will: 💬 At Confido, transparency isn’t just a value — it’s a practice. Our clients receive clear pricing proposals with defined deliverables and no hidden costs. Get in touch for a customized quote based on your business stage and goals.

| ||||||||||||||||||||||||

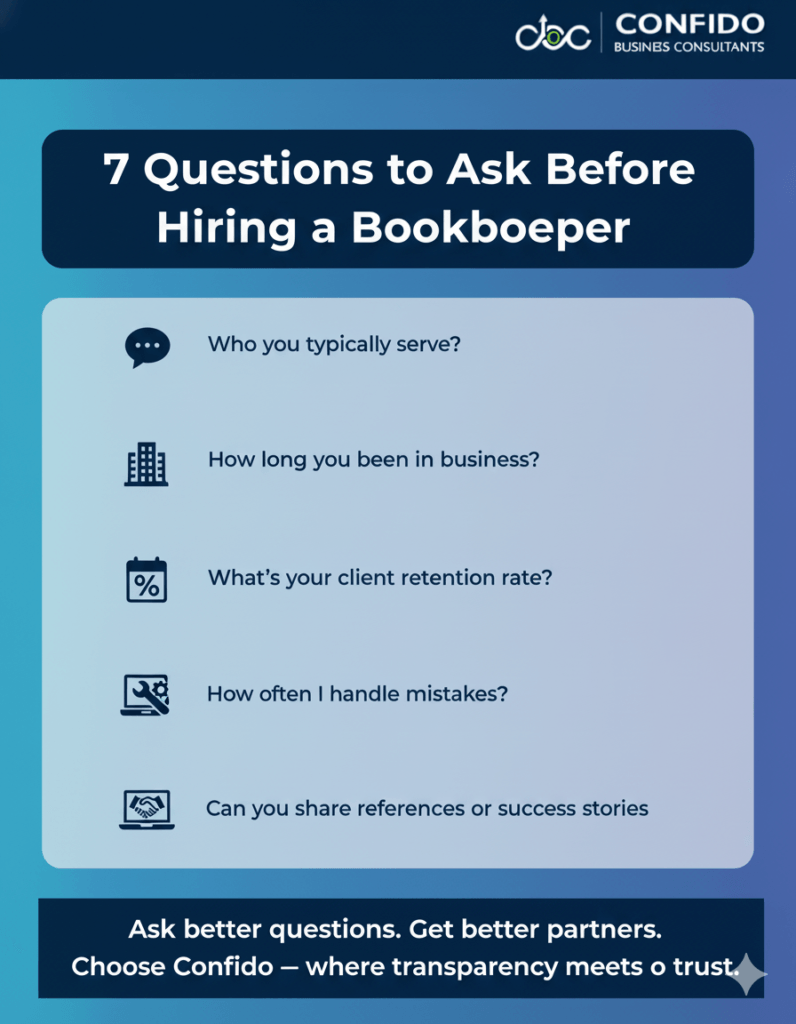

Questions to Ask Before Hiring – Key Questions (Turnover, Client Size, Retention, References)Hiring a bookkeeping service isn’t just about price — it’s about trust, experience, and alignment with your business goals. Asking the right questions upfront helps you gauge whether a provider truly understands your business or is merely selling a service. The best bookkeeping firms encourage these questions — because they have nothing to hide. Step 1: Understand Their Experience & ExpertiseStart by getting clarity on who they work with and how long they’ve been doing it. Ask:

Why it matters: A bookkeeping provider experienced in your industry or business size can anticipate your unique challenges — whether its cash flow for retail, deferred revenue for SaaS, or compliance for international founders. 💡 Pro Tip: Step 2: Learn About Their Client Retention and CommunicationYou’re not just outsourcing your books — you’re outsourcing a relationship. Ask:

These questions reveal how stable, communicative, and service-oriented a provider truly is. A firm that boasts long-term relationships and frequent touchpoints values clarity and continuity — key to a smooth partnership. Step 3: Verify Transparency & AccountabilityTransparency builds confidence. Ensure the firm is accountable for both their work and your data. Ask:

Their response will show whether they emphasize accuracy, visibility, and responsibility — or operate reactively when issues arise. 💡 Pro Tip: Step 4: Ask for References or Case StudiesGood bookkeeping firms are proud of their client results. Ask:

💬 At Confido, we believe transparency is part of great service. Our clients stay with us because of measurable outcomes — not long contracts. Talk to us to learn how we’ve helped businesses like yours streamline their bookkeeping, compliance, and growth.

| ||||||||||||||||||||||||

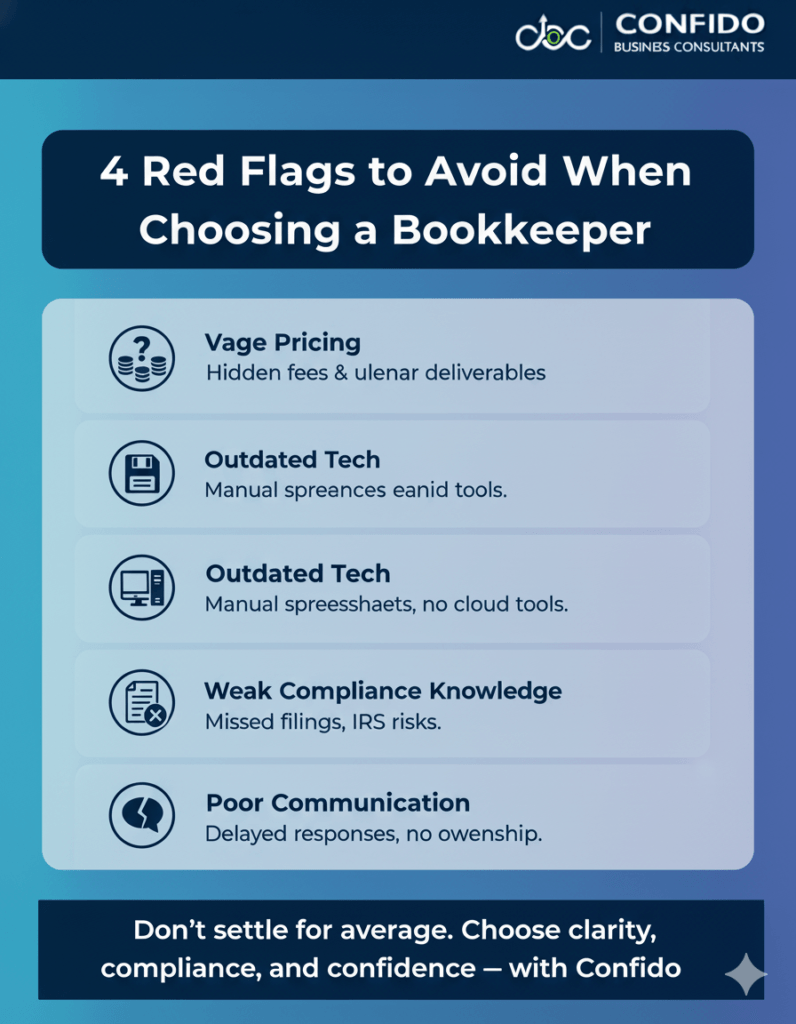

Red Flags to Avoid – Vague Pricing, Lack of Technology, Limited Compliance KnowledgeChoosing a bookkeeping partner is a critical decision — but many small businesses fall into traps that cost them time, money, and peace of mind. It’s not just about who’s cheapest or friendliest; it’s about identifying warning signs that reveal long-term risk. Here are the biggest red flags to watch out for before signing any bookkeeping agreement. 🚩 Red Flag 1: Vague or Non-Transparent PricingIf a provider can’t explain their pricing clearly — or keeps adding “extra” charges after you sign — that’s a problem. Hidden fees often indicate poor process control or a lack of respect for your business. Why it matters: Ask yourself:

✅ What to look for instead: 🚩 Red Flag 2: Lack of Technology or Integration SupportManual spreadsheets and outdated software are dealbreakers in 2025. If your bookkeeper still asks you to email PDFs or send Excel files every month, you’re dealing with inefficiency — and potential security risks. Why it matters: ✅ What to look for instead: 💡 Pro Tip: 🚩 Red Flag 3: Limited Knowledge of Compliance & Tax RegulationsBookkeeping isn’t just data entry — it’s the foundation of compliance. If your provider can’t confidently explain how they handle payroll taxes, sales tax filings, or IRS form deadlines, you’re at risk of penalties. Why it matters: ✅ What to look for instead:

🚩 Red Flag 4: Poor Communication or Unclear ProcessesIf it takes days to get a response — or if you don’t know who your point of contact is — you’re already losing valuable time. Why it matters: ✅ What to look for instead: 💬 At Confido, we believe clear communication, transparent pricing, and modern tools are non-negotiable. We combine accounting expertise with automation and security — so your books stay accurate, compliant, and audit-ready. Talk to our team today to see how we work differently.

| ||||||||||||||||||||||||

Scalability & Growth Support – Will the Provider Scale with Your Business?When choosing a bookkeeping service, think beyond your current needs. The real question isn’t “Can they manage my books now?” — it’s “Will they still be the right partner when my business doubles in size?” Scalability is what separates short-term vendors from long-term growth partners. Why Scalability MattersAs your business expands, your bookkeeping needs become more complex. You might start with basic reconciliation and expense tracking — but over time, you’ll need:

A scalable bookkeeping partner grows with you — adapting services, tools, and insights without disrupting your operations. 💡 Pro Tip: Signs of a Scalable Bookkeeping PartnerWhen evaluating your options, look for signs that the firm is built for growth: ✅ Modular Service Packages: ✅ Cloud-Based Systems: ✅ Process Automation: ✅ Financial Advisory Integration: ✅ Multi-Entity or Multi-Currency Support: How Confido Scales With YouAt Confido, scalability isn’t an afterthought — it’s built into our DNA. As you grow, we evolve your financial systems with:

💬 Whether you’re a solopreneur managing invoices or a scaling business preparing for funding rounds, Confido grows with you — ensuring your financial systems never hold you back. Schedule a consultation to explore how our scalable bookkeeping solutions can future-proof your growth.

| ||||||||||||||||||||||||

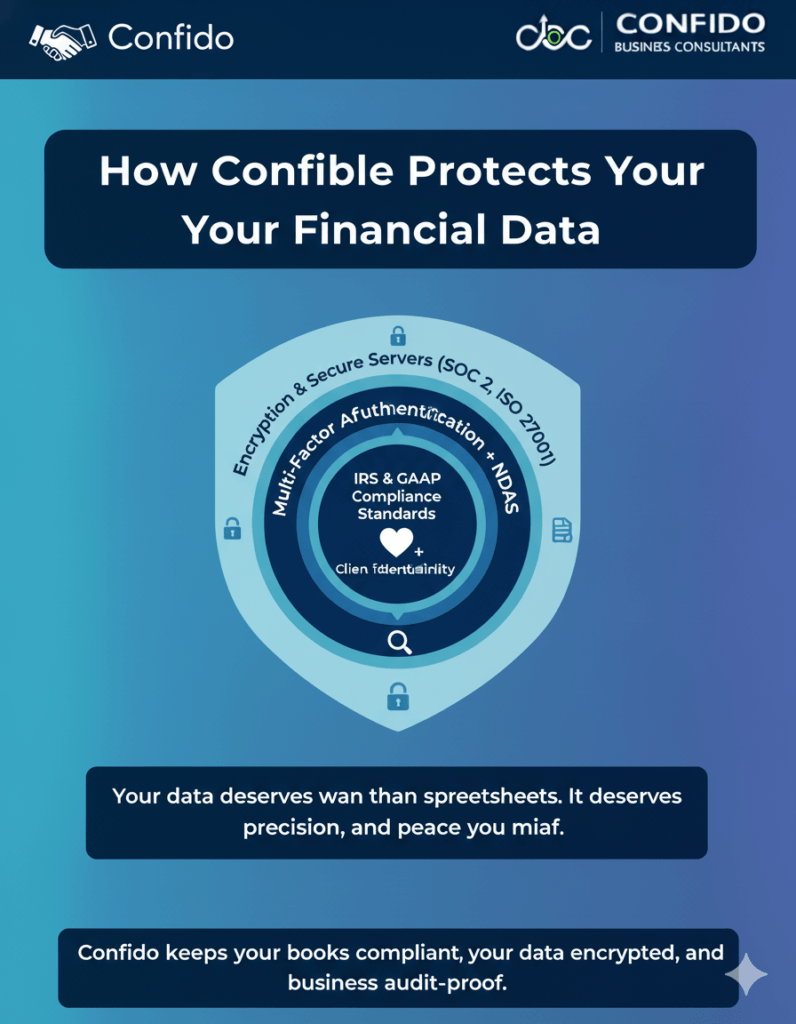

Compliance & Security Measures – Data Security, IRS/CPA Compliance, How Records Are ManagedWhen outsourcing bookkeeping, trust doesn’t just mean accuracy — it means protection. Your financial records contain sensitive information: payroll, tax IDs, invoices, and banking data. If that data is mishandled, the consequences can be costly — from IRS penalties to cybersecurity risks. That’s why compliance and data security aren’t optional — they’re the cornerstones of professional bookkeeping. 1. Data Security Comes FirstBookkeeping is now as much about cyber protection as it is about balance sheets. A secure bookkeeping partner should:

💡 Pro Tip: Never share your credentials or banking details over email — always through secure portals or shared drives. 2. IRS & CPA Compliance StandardsFinancial data accuracy isn’t just for reporting — it’s a legal obligation. A qualified bookkeeping firm ensures compliance with IRS and CPA standards, helping you avoid late filings, mismatched records, or audit risks. Your bookkeeping provider should:

💡 Pro Tip: A firm that understands compliance also helps you claim legitimate deductions, maximizing savings while staying within legal bounds. 3. Record Management & Access TransparencyTransparency means you should always know where your data lives and how to retrieve it. Messy, offline recordkeeping leads to chaos during audits or funding rounds. A professional firm should:

💬 At Confido, we treat your data with the same confidentiality we apply to our own. Our systems use bank-level encryption, cloud compliance, and continuous monitoring — giving you peace of mind and audit readiness year-round. Get in touch to learn how we secure your books while keeping you IRS-ready.

| ||||||||||||||||||||||||

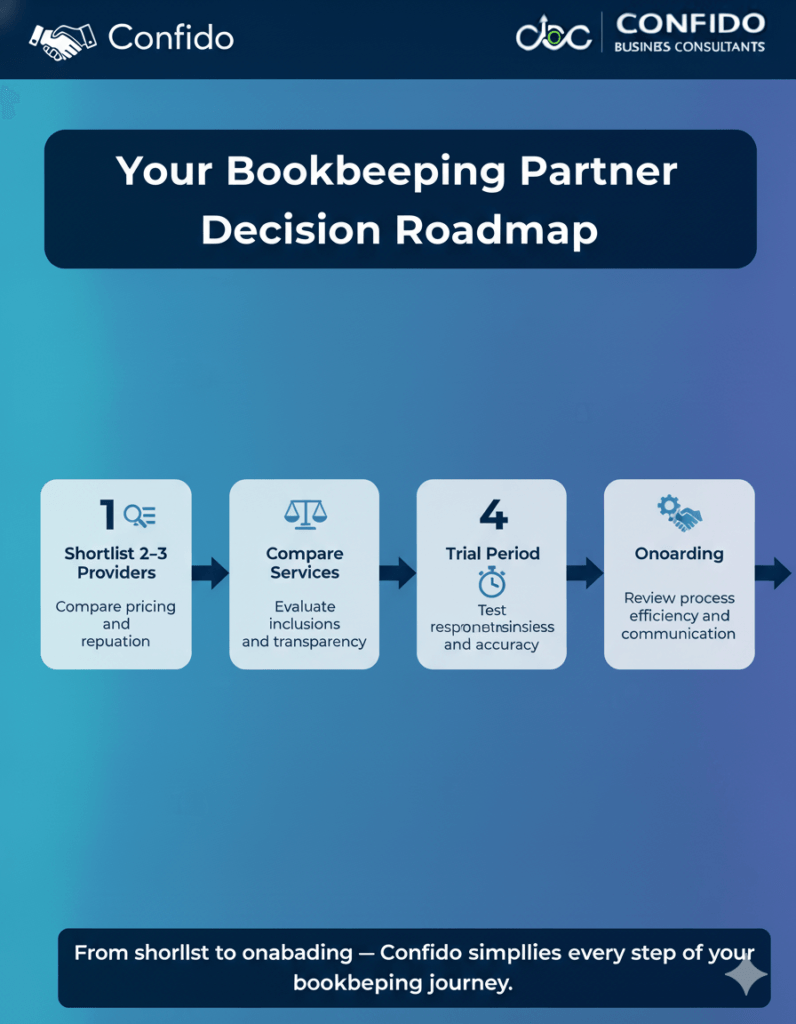

Making the Final Decision – Shortlisting, Trial Period, Onboarding TipsBy this stage, you’ve done your homework: compared pricing, checked reviews, asked tough questions, and noted red flags. Now comes the most crucial part — making the final call. Choosing the right bookkeeping partner is about balancing logic and trust: the numbers must add up, but so should the people behind them. Here’s how to finalize your decision with clarity and confidence. Step 1: Create a Shortlist of 2–3 ProvidersDon’t stop at the first “good enough” option. Narrow down your choices to two or three firms that meet your must-haves: ✅ Transparent pricing. 💡 Pro Tip: Review each provider’s website and client testimonials carefully — genuine firms often showcase case studies and industry-specific wins, not generic praise. Step 2: Compare Service Inclusions, Not Just PriceMany business owners fall into the “cheap now, costly later” trap. Instead of comparing only the dollar amount, evaluate what’s included in that price:

A $500 monthly package that includes proactive support can easily outperform a $300 plan that leaves you fixing mistakes every quarter. Step 3: Request a Trial or Discovery PeriodBefore signing a long-term contract, ask for a 30-day trial or discovery phase. This allows you to assess responsiveness, communication, and accuracy without committing fully. During the trial, observe how the provider:

💡 Pro Tip: The best firms don’t shy away from trials — they know their process and service will speak for itself. Step 4: Smooth Onboarding is a Green FlagThe onboarding process reveals how organized your bookkeeper really is. A professional bookkeeping partner should:

💬 At Confido, onboarding is a breeze. We migrate your data securely, set up your accounting tools, and deliver your first reconciled report within weeks — ensuring zero disruption to your operations. Talk to us to experience how effortless professional bookkeeping can be.

| ||||||||||||||||||||||||

FAQ Section

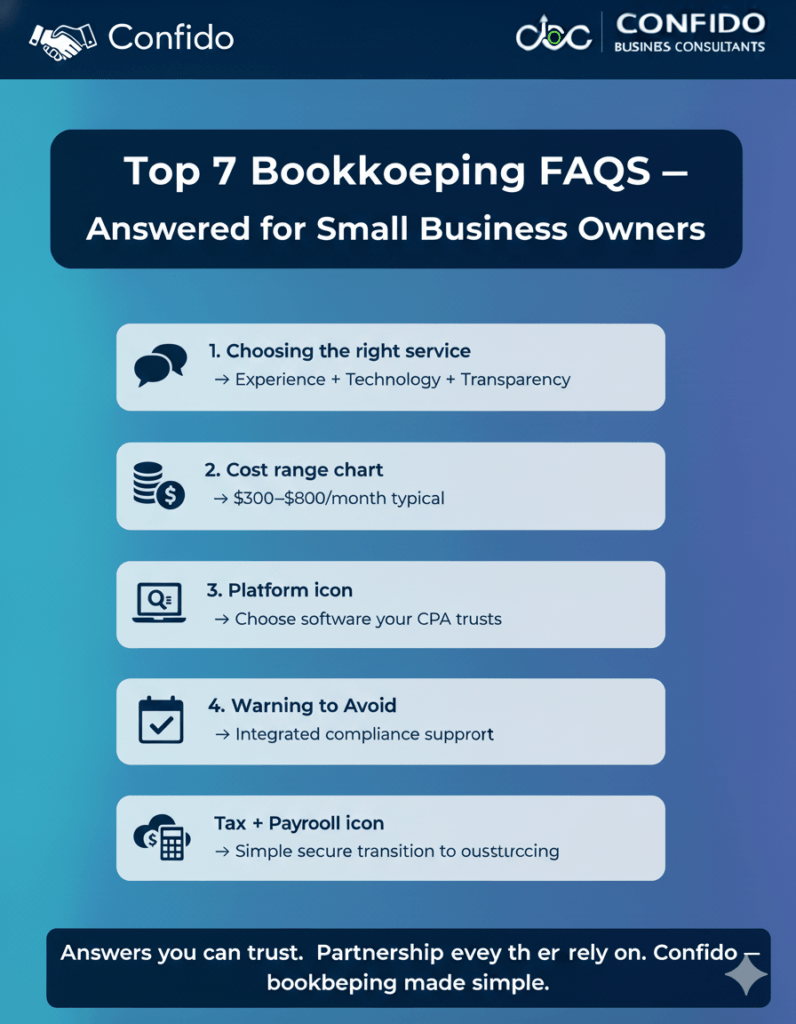

What should small businesses look for in a bookkeeping service?

Look for a bookkeeping partner who combines accuracy, transparency, and technology. Your ideal provider should use cloud-based tools (like QuickBooks or Xero), have proven experience with small businesses, and maintain clear communication. Bonus points if they offer scalable plans that grow with your business.

💡 Confido Insight: We help businesses move from messy spreadsheets to smart, cloud-driven systems with full visibility and compliance — no accounting jargon, just clarity.

How much does outsourcing bookkeeping cost for small businesses?

The cost varies based on business complexity, transaction volume, and services included. On average, U.S. small businesses pay:

$300–$800/month for basic bookkeeping (reconciliations, reporting, categorization).

$1,000+/month for expanded services like payroll, tax support, or multi-entity management.

Transparent firms will provide clear, written proposals with no hidden fees — a hallmark of trustworthy partners like Confido.

Should I choose a bookkeeping service that uses QuickBooks or something else?

QuickBooks Online remains the most widely used and trusted platform for small businesses due to its robust integrations, bank feeds, and CPA compatibility. However, depending on your setup, Xero, Zoho Books, or FreshBooks may also work.

The key is choosing a provider proficient in your preferred platform and capable of automating data flow between your invoicing, payroll, and reporting systems.

💡 Pro Tip: Confido is a certified QuickBooks partner but also supports multi-platform clients — ensuring flexibility without compromising accuracy.

What are the red flags when hiring a bookkeeping provider?

Some warning signs to watch for include:

🚩 Vague pricing (no clear deliverables or “extra” charges).

🚩 Outdated tools (manual spreadsheets instead of cloud software).

🚩 Slow communication or unclear points of contact.

🚩 No knowledge of compliance or tax deadlines.

A good bookkeeping service will be transparent about pricing, processes, and responsibilities — ensuring your peace of mind from day one.

How often should I meet with my outsourced bookkeeper?

Most small businesses benefit from monthly check-ins to review financial statements, cash flow, and upcoming deadlines. Larger or fast-scaling businesses may opt for bi-weekly syncs.

Regular reviews prevent errors, ensure compliance, and help you make informed financial decisions — instead of waiting for surprises at year-end.

💬 At Confido, we prioritize proactive communication — not reactive corrections. Our monthly insights meetings help you stay on top of your books and ahead of your goals. Get in touch to set up your free consultation.

Can a bookkeeping service support tax compliance and payroll too?

Yes. Modern bookkeeping firms like Confido handle end-to-end financial management, which includes:

Payroll processing and reporting.

Sales tax and income tax filings.

1099 and W-2 preparation.

IRS form submissions and compliance monitoring.

Outsourcing these functions ensures consistency, accuracy, and compliance under one roof — without juggling multiple vendors.

How do I transition from in-house bookkeeping to an outsourced service?

A smooth transition involves three main steps:

1️⃣ Data Collection: Gather bank statements, receipts, and prior reports.

2️⃣ Software Setup: Grant secure access to your accounting platform (QuickBooks, Xero, etc.).

3️⃣ Onboarding & Review: Your new provider reviews existing data, fixes discrepancies, and sets up workflows.

💡 Pro Tip: Confido’s onboarding team makes this transition seamless. We migrate your data securely, clean up historical inconsistencies, and deliver your first reconciled report within weeks — without disrupting your business.

Partner with Confido for Stress-Free Bookkeeping

Finding the right bookkeeping service can feel overwhelming — endless options, unclear pricing, and too much jargon.

But once you know what to look for — transparency, technology, compliance, and trust — the decision becomes much simpler.

A good bookkeeping partner doesn’t just manage your books. They help you understand your numbers, anticipate your challenges, and empower your growth.

That’s what we do at Confido.

We work with small businesses across the U.S. and international founders expanding into the U.S. market — helping them:

✅ Simplify accounting operations.

✅ Stay compliant with tax and payroll regulations.

✅ Gain real-time visibility into cash flow.

✅ Build scalable systems that grow with them.

Whether you’re switching from in-house bookkeeping or starting fresh, we ensure a smooth, secure, and insightful transition — so you can focus on building your business, not chasing receipts.

💬 Your books deserve better than chaos and catch-up.

Let’s build a financial system that supports your growth — accurate, compliant, and effortless. Talk to us today to see how Confido can be your trusted bookkeeping partner.