Remote & Outsourced Bookkeeping in 2026: Pros, Cons & When It Makes Sense

Introduction — Why Remote & Outsourced Bookkeeping Is Growing in 2026In 2026, bookkeeping looks very different from what it did even a few years ago. Small businesses, startups, and international founders are no longer tied to local hires, physical offices, or manual spreadsheets. Instead, they’re embracing remote and outsourced bookkeeping as a smarter, more flexible way to manage finances. This shift isn’t just about convenience—it’s about survival, scalability, and control. Business owners today are asking sharper questions:

The answer, increasingly, is yes. Remote and outsourced bookkeeping services now combine cloud accounting platforms, real-time reporting, automation, and specialist expertise—making them especially attractive for SMEs, startups, and globally distributed businesses. With rising labor costs, tighter compliance requirements, and growing pressure to make data-driven decisions, businesses are rethinking how (and where) their books are managed. In this guide, we’ll break down what remote and outsourced bookkeeping really means in 2026, the pros and cons, and—most importantly—when it makes sense for your business. If you’re deciding between keeping bookkeeping in-house or moving to a remote model, this is your definitive, no-fluff resource. If you’re already considering outsourcing your bookkeeping—or wondering whether your current setup is holding you back—talk to a Confido expert for a quick, no-obligation assessment. | ||||||||||||||||||

Section 2 — What Is Remote & Outsourced Bookkeeping?Before weighing pros and cons, it’s important to clearly understand what remote and outsourced bookkeeping actually means in practice—because many business owners still confuse it with basic data entry or offshore accounting. In 2026, outsourced bookkeeping is far more strategic, tech-enabled, and compliance-driven than it was even five years ago.

What Is Remote Bookkeeping?Remote bookkeeping means your bookkeeping function is handled off-site, using secure cloud-based accounting systems rather than someone physically working from your office. Key characteristics:

Your bookkeeper may be located in another city—or another country—but your data is always accessible and up to date.

What Is Outsourced Bookkeeping?Outsourced bookkeeping goes a step further. Instead of hiring an individual, you partner with a professional bookkeeping firm that manages your books as an ongoing service. This typically includes:

Outsourced bookkeeping is especially common among startups, SMEs, and growing businesses that want expertise without the cost and risk of building an in-house finance team.

Remote vs Outsourced: How They OverlapIn 2026, most outsourced bookkeeping services are also remote. Think of it this way:

Confido, for example, provides remote, outsourced bookkeeping—combining technology, expertise, and compliance support in one integrated service.

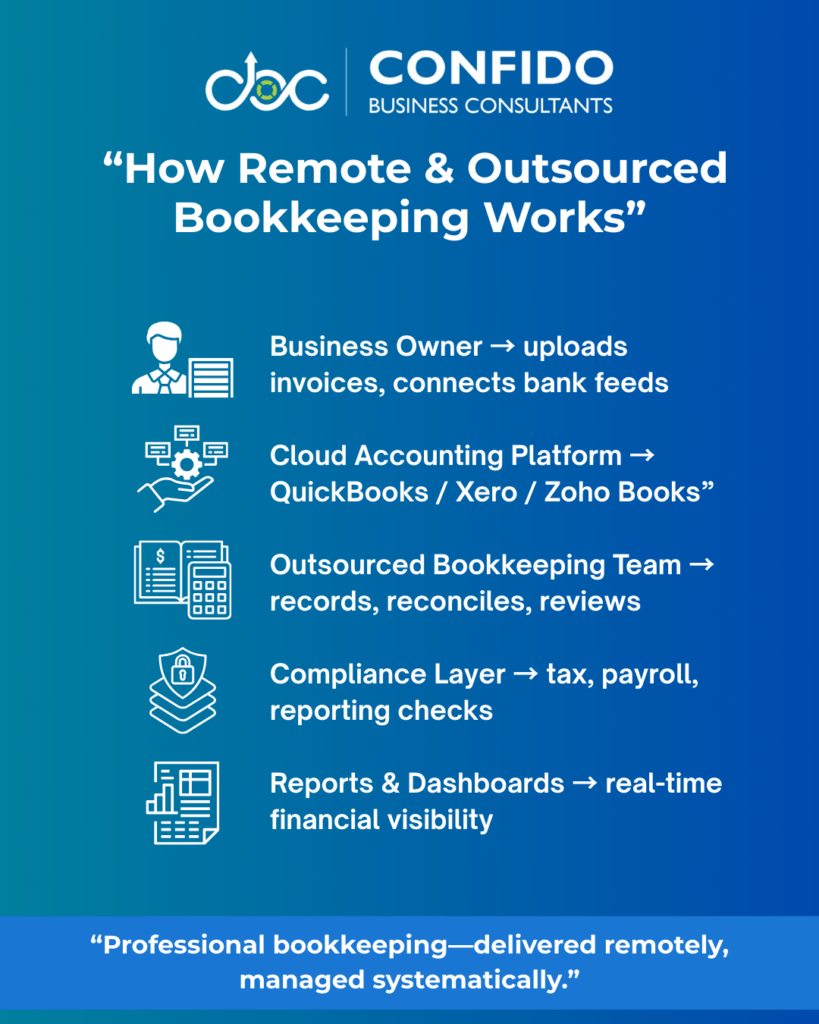

How Remote & Outsourced Bookkeeping Works in PracticeHere’s what the process typically looks like for a small business: 1. Onboarding & System Setup

2. Ongoing Transaction Management

3. Monthly Reviews & Reporting

4. Compliance & Coordination

All of this happens remotely—but with structured workflows, secure access controls, and documented processes.

Why This Model Works in 2026Remote and outsourced bookkeeping succeeds today because:

Instead of relying on one in-house hire to “do everything,” businesses now prefer teams that specialize, supported by systems designed for scale.

If you’re curious how remote and outsourced bookkeeping would work for your business—based on your size, industry, and compliance needs—Confido can map it out clearly. | ||||||||||||||||||

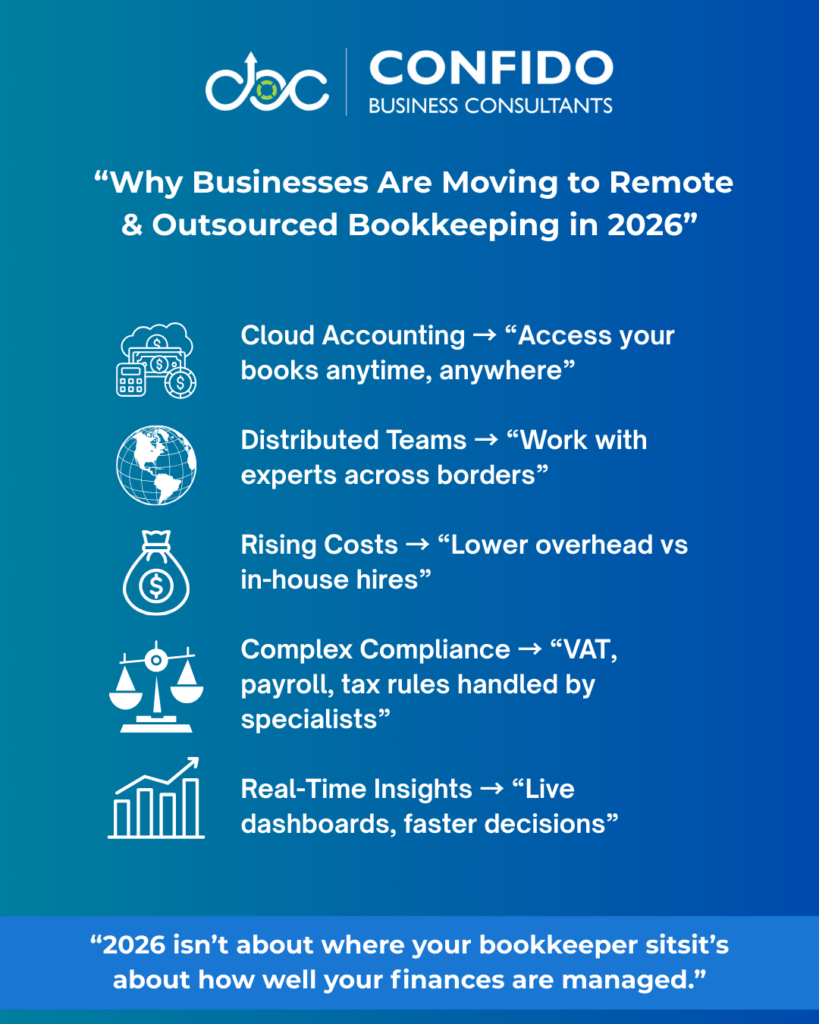

Section 3 — Why More Businesses Are Choosing Remote & Outsourced Bookkeeping in 2026Remote and outsourced bookkeeping isn’t a passing trend—it’s a structural shift driven by how businesses operate, hire, and scale in 2026. The decision is no longer just about saving money; it’s about staying agile, compliant, and informed in a more complex business environment. Here are the four biggest forces accelerating adoption. Cloud Accounting Has Become the DefaultCloud accounting platforms have matured significantly. In 2026, tools like QuickBooks Online, Xero, Zoho Books, and NetSuite offer:

This means your books no longer live on a desktop—or with one person. They live in the cloud, accessible to you, your accountant, and your outsourced bookkeeping team at any time. For business owners, this translates into:

Cloud accounting is the foundation that makes remote bookkeeping reliable and scalable.

Distributed Teams Are Now the NormThe modern business rarely operates from a single location. In 2026, it’s common to see:

With teams already distributed, it no longer makes sense to insist bookkeeping be local or in-house. Remote and outsourced bookkeeping fits naturally into this structure:

For international founders and remote-first companies, outsourced bookkeeping ensures financial consistency—even as the business scales across borders.

Cost Pressures Are Forcing Smarter DecisionsHiring an in-house bookkeeper in 2026 is expensive. Beyond salary, businesses must factor in:

In contrast, outsourced bookkeeping services offer:

For startups and SMEs, this cost efficiency often frees up capital for growth activities—sales, marketing, product development—rather than administrative overhead.

Compliance Is Getting More ComplexPerhaps the biggest driver of outsourcing is regulatory pressure. In many jurisdictions, businesses now face:

Trying to manage bookkeeping, tax prep, payroll, and compliance internally—especially without specialist knowledge—can expose businesses to errors and penalties. Outsourced bookkeeping firms bring:

This is especially valuable for businesses operating in multiple regions or under evolving tax regimes.

If compliance complexity or rising costs are pushing you to rethink your bookkeeping model, Confido helps businesses transition smoothly to a remote, outsourced setup—without disruption. | ||||||||||||||||||

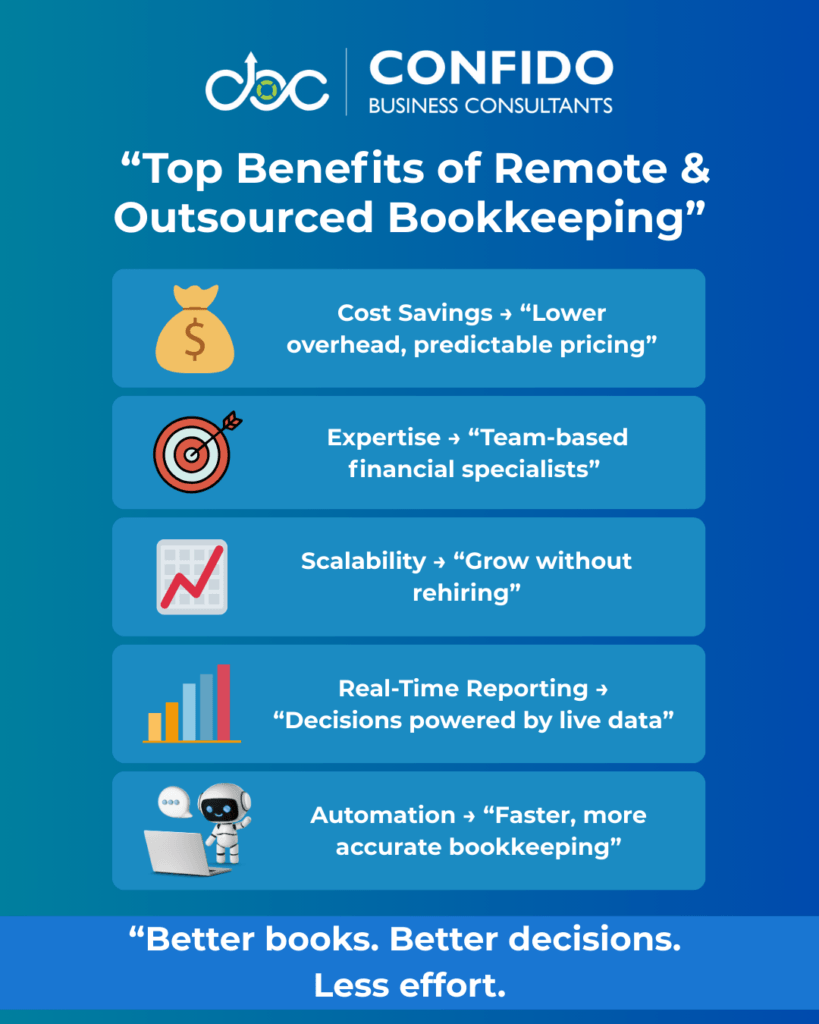

Section 4 — Pros of Remote & Outsourced BookkeepingFor many businesses in 2026, remote and outsourced bookkeeping isn’t just an alternative—it’s a competitive advantage. When done right, it delivers better financial clarity, stronger compliance, and lower overhead than traditional in-house models. Below are the key benefits driving adoption, explained in practical terms. Cost Savings Without Compromising QualityOne of the most immediate benefits is cost efficiency. With outsourced bookkeeping, businesses avoid:

Instead, you pay a fixed or scalable monthly fee based on your transaction volume and reporting needs. This makes budgeting easier and removes the uncertainty associated with hiring. For startups and SMEs, these savings often make the difference between simply staying afloat and being able to reinvest in growth.

Access to Specialized ExpertiseIn-house bookkeepers are often generalists. Outsourced bookkeeping firms, by contrast, offer team-based expertise. This typically includes:

Your books are reviewed through structured processes, reducing errors and ensuring best practices are followed consistently. This is especially valuable when your business deals with:

Instead of relying on one person, you benefit from a depth of knowledge.

Scalability as Your Business GrowsBusiness needs change—often faster than expected. Remote and outsourced bookkeeping scales easily:

There’s no need to hire, retrain, or restructure your finance team. The service adapts as your business evolves, making it ideal for fast-growing startups and dynamic SMEs.

Real-Time Reporting & Better Decision-MakingModern outsourced bookkeeping is built on cloud platforms that deliver live financial visibility. You gain access to:

This allows business owners to:

Instead of waiting for month-end reports, you operate with current data.

Advanced Technology & AutomationOutsourced bookkeeping firms invest heavily in technology so you don’t have to. This includes:

Automation reduces manual work, improves accuracy, and speeds up reporting cycles. It also ensures your systems remain current as tools evolve.

If these benefits sound like what your business needs in 2026, Confido helps companies unlock the full value of remote and outsourced bookkeeping—without disruption. | ||||||||||||||||||

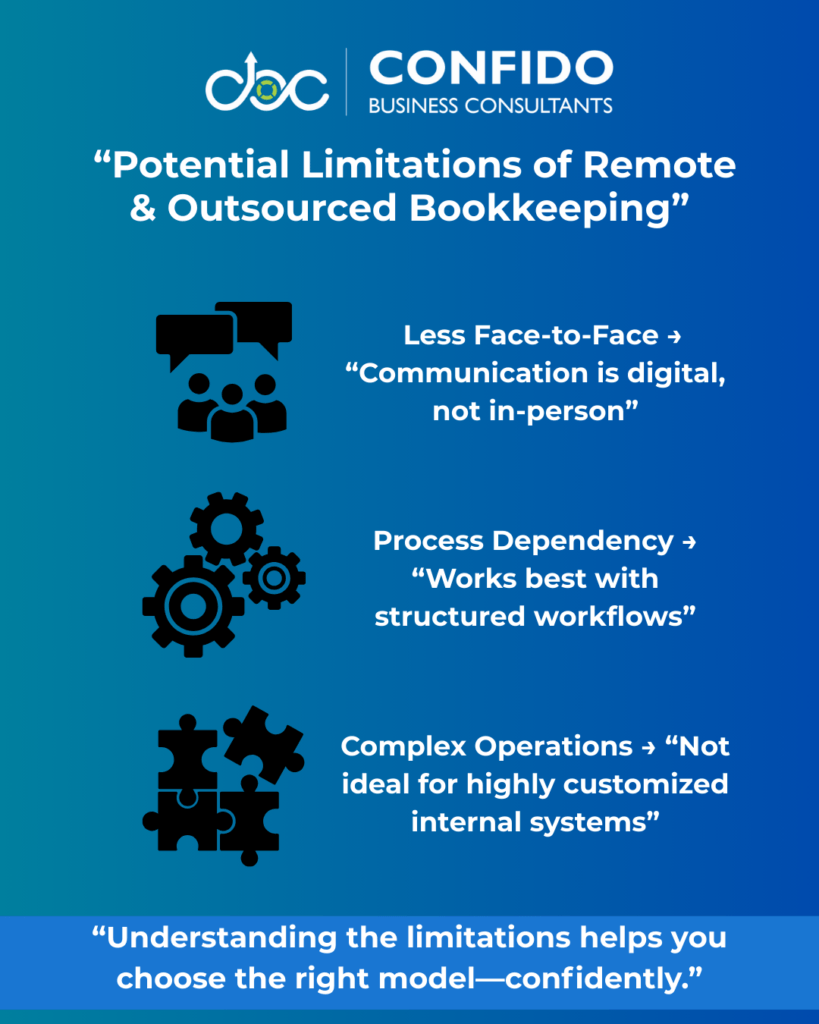

Section 5 — Cons & Limitations to ConsiderRemote and outsourced bookkeeping offers powerful advantages—but it’s not a universal fit for every business. Decision-stage readers expect honesty, and understanding the limitations helps you make a confident, informed choice. Below are the key drawbacks to consider, along with context on when they truly matter.

Less Face-to-Face InteractionOne of the most common concerns business owners raise is the lack of in-person interaction. With remote bookkeeping:

For owners who prefer hands-on oversight or spontaneous discussions, this can feel like a loss of control—especially in the early stages of the relationship. That said, many businesses find that structured communication (scheduled reviews, shared dashboards, documented processes) actually leads to better clarity than ad hoc in-person interactions.

Dependency on Processes & CommunicationRemote bookkeeping works best when processes are clearly defined. This means:

If internal workflows are disorganized—or if teams are slow to share information—outsourced bookkeeping can feel less responsive than expected. In contrast, businesses with:

tend to see smoother, faster results. The success of outsourcing depends as much on internal readiness as it does on the service provider.

Not Ideal for Very Complex Internal WorkflowsSome organizations have highly customized or deeply embedded internal finance processes. Examples include:

In these cases, an in-house or hybrid model may still make sense—at least for certain functions. However, even complex organizations often outsource specific components (e.g., transactional bookkeeping, reconciliations, reporting prep) while retaining strategic finance roles internally.

Context Matters More Than the DrawbacksIt’s important to note that most of these limitations are context-dependent. For startups, SMEs, and remote-first businesses, they’re often minor compared to the benefits. The real question isn’t: “Are there any downsides?” It’s: “Do these downsides matter for my business model?”

Not sure whether remote & outsourced bookkeeping is the right fit for your workflows? Confido helps you evaluate your setup honestly—no pressure, no generic advice. | ||||||||||||||||||

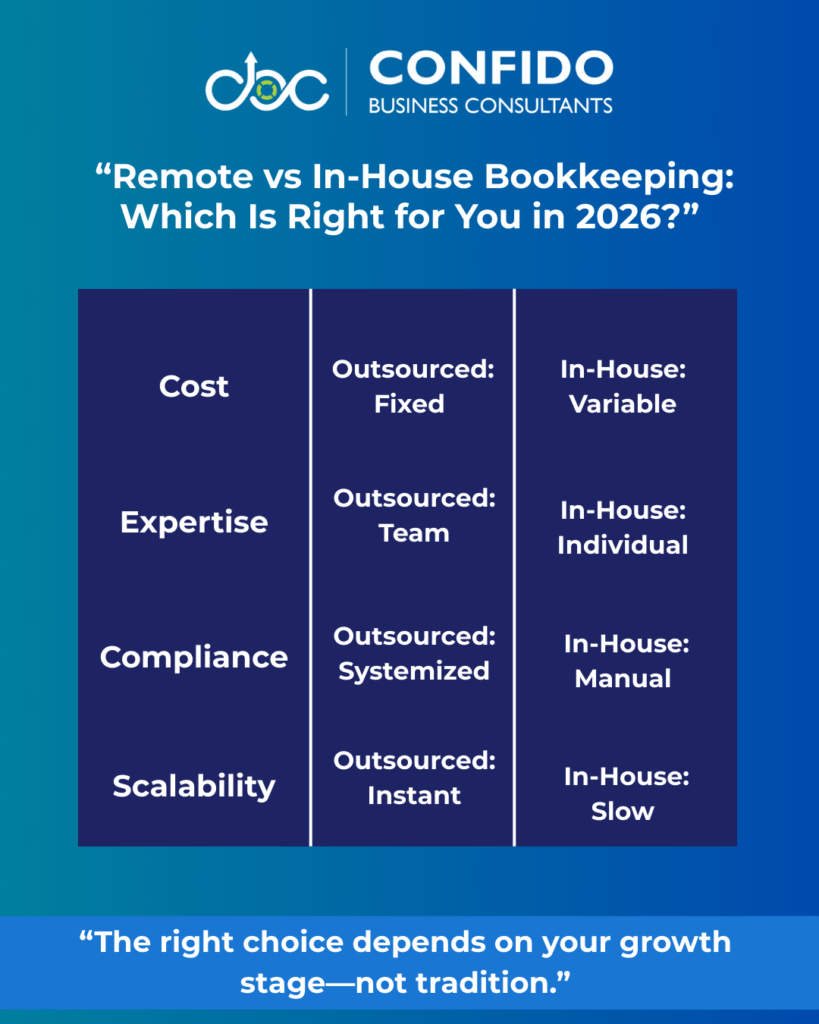

Section 6 — Remote vs In-House Bookkeeping (Comparison Table)When deciding between remote & outsourced bookkeeping and an in-house model, business owners want a clear, side-by-side comparison—not opinions. Below is a practical breakdown across the factors that matter most in 2026. Remote vs In-House Bookkeeping: At a Glance

Cost: Predictability vs OverheadRemote & Outsourced:

In-House:

Best for: Businesses prioritizing cost control and flexibility.

Control: Structured Visibility vs Physical PresenceRemote & Outsourced:

In-House:

Best for:

Expertise: Team Depth vs Single ResourceRemote & Outsourced:

In-House:

Best for: Businesses needing breadth of expertise without multiple hires.

Compliance: Systems vs IndividualsRemote & Outsourced:

In-House:

Best for: Businesses operating in complex or changing regulatory environments.

Scalability: Elastic vs FixedRemote & Outsourced:

In-House:

Best for: Startups and SMEs planning to grow or pivot.

Still unsure which model fits your business best? Confido helps you evaluate costs, workflows, and compliance needs—then recommends the right setup. | ||||||||||||||||||

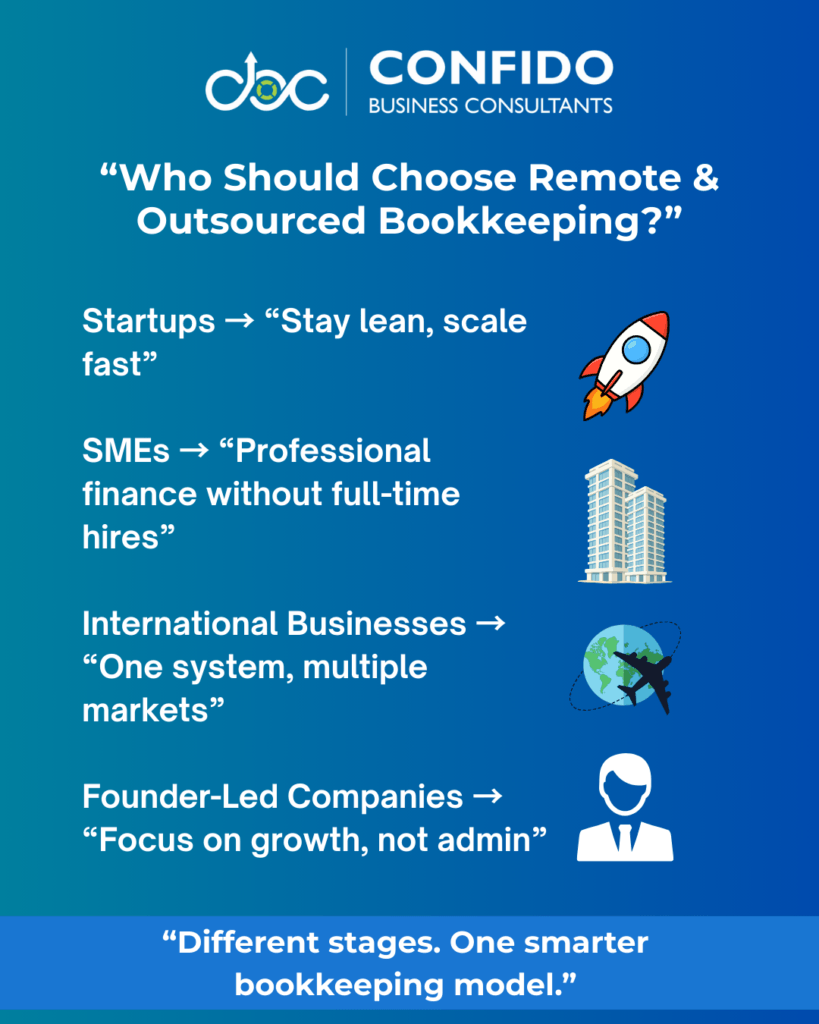

Section 7 — When You Should Choose Remote & Outsourced BookkeepingRemote and outsourced bookkeeping isn’t just a cost-saving move—it’s a strategic choice that aligns especially well with certain business models and growth stages. If your situation matches any of the scenarios below, outsourcing is often the smarter option in 2026. StartupsStartups thrive on speed, flexibility, and focus—and bookkeeping is rarely where founders want to spend time. Remote and outsourced bookkeeping is ideal for startups because it:

Instead of building an internal finance function too early, startups can rely on outsourced bookkeeping to maintain accuracy while staying lean.

Small & Medium-Sized Businesses (SMEs)For SMEs, the challenge is often outgrowing informal processes without overbuilding overhead. Outsourced bookkeeping helps SMEs:

Many SMEs reach a point where spreadsheets and ad hoc bookkeeping no longer work—but a full in-house department isn’t justified. Outsourcing fills that gap perfectly.

International BusinessesInternational and cross-border businesses face unique challenges:

Remote bookkeeping fits naturally into this structure. It centralizes financial data in the cloud while allowing expert teams to manage jurisdiction-specific requirements. For international founders operating in markets like the U.S., UAE, or beyond, outsourced bookkeeping ensures consistency and compliance without geographic limitations.

Founder-Led CompaniesIn founder-led businesses, time is the most valuable resource. Outsourcing bookkeeping allows founders to:

Instead of being reactive—scrambling at tax time or month-end—founders gain a proactive financial partner.

“Choose Outsourced Bookkeeping If…” (Quick Summary)Remote & outsourced bookkeeping is a strong fit if:

If your business fits any of these scenarios, Confido can help you transition smoothly to remote and outsourced bookkeeping—without disruption to operations. | ||||||||||||||||||

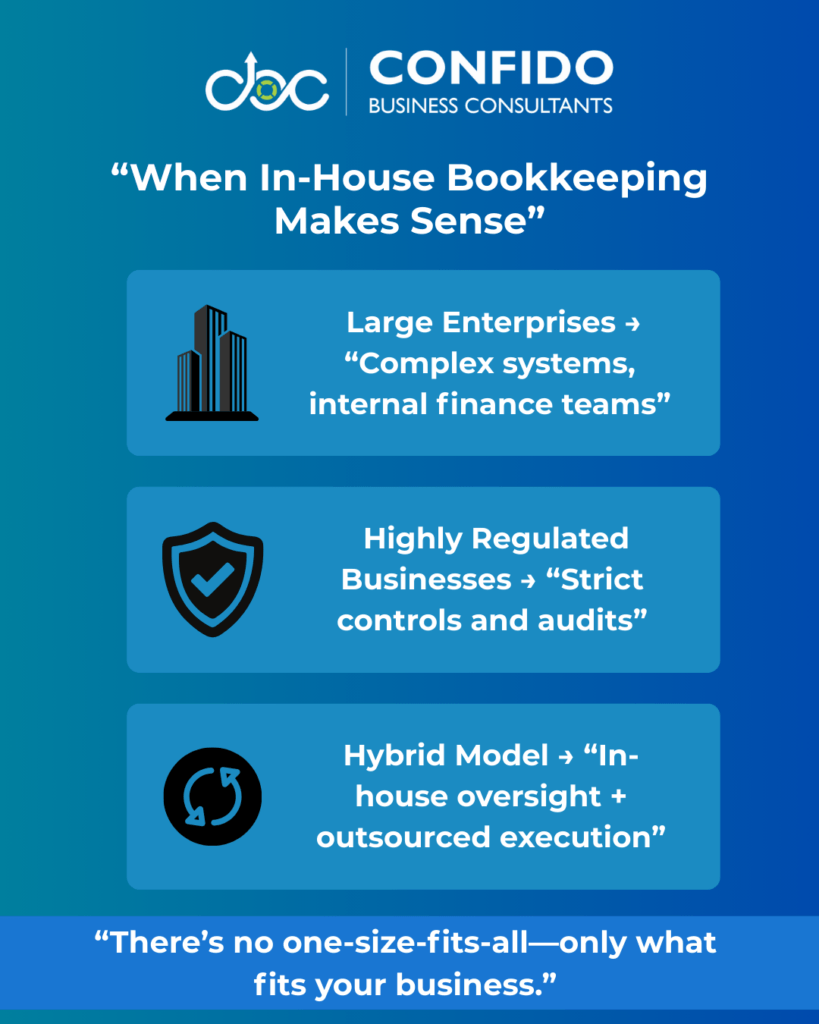

Section 8 — When In-House Bookkeeping Might Still Make SenseWhile remote and outsourced bookkeeping works well for many businesses in 2026, it’s not the right answer in every situation. Certain organizations benefit from keeping bookkeeping functions fully in-house—or at least adopting a hybrid model. Understanding these scenarios helps ensure you choose what’s practical, not just popular. Large EnterprisesLarge organizations often have:

In these environments, in-house bookkeeping can offer:

For enterprises with dedicated finance departments, the bookkeeping function is typically embedded within broader financial operations, making full outsourcing less practical. That said, even large companies sometimes outsource specific components—such as reconciliations, reporting preparation, or overflow work—while keeping strategic oversight internal.

Highly Regulated or Customized Internal ProcessesSome businesses operate under strict internal or external controls, including:

In these cases, in-house bookkeeping may provide:

However, these businesses often still benefit from specialist external support for compliance, tax preparation, or technical accounting—creating a hybrid structure rather than a fully in-house setup.

Hybrid Models: A Practical Middle GroundFor many organizations, the choice isn’t strictly outsourced or in-house. Hybrid models combine:

This approach balances control with efficiency—especially during periods of growth or transformation.

Not sure whether in-house, outsourced, or a hybrid model fits your business best? Confido helps you evaluate your operations and design a bookkeeping setup that actually works. | ||||||||||||||||||

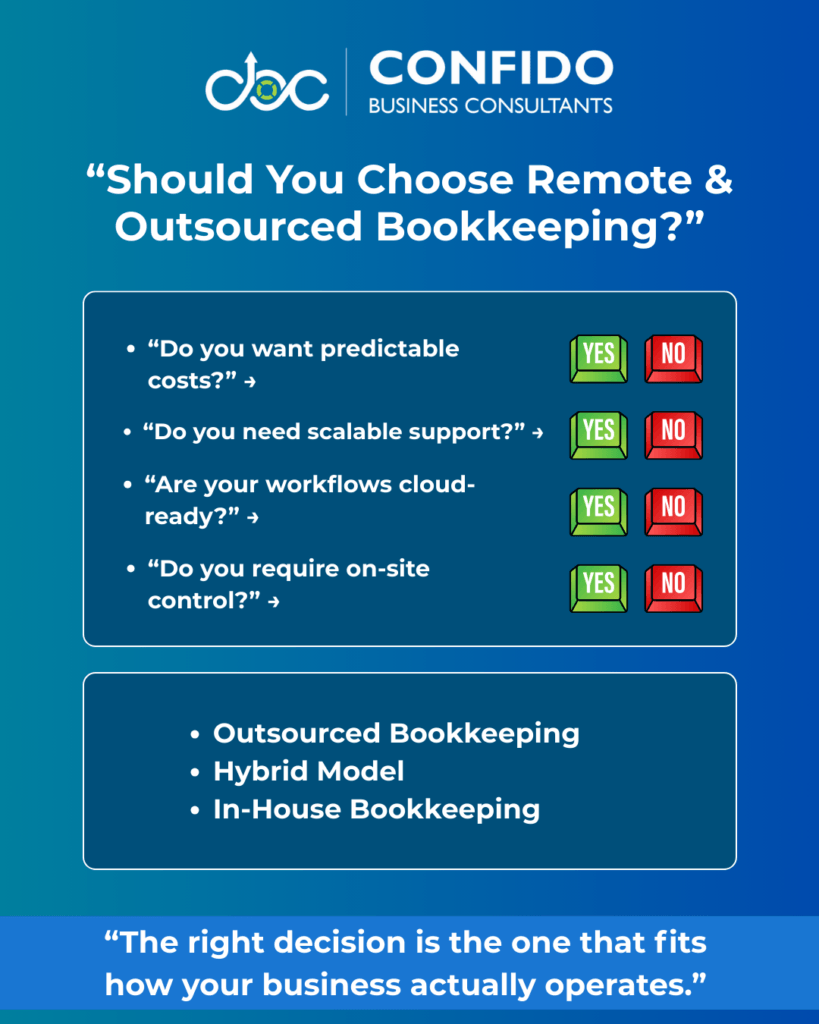

Section 9 — How to Decide: A Simple ChecklistIf you’re still weighing remote & outsourced bookkeeping against an in-house model, the best way forward is a clear decision framework. Rather than relying on instinct, use the checklist below to evaluate what your business actually needs in 2026. This section is designed to help decision-stage readers arrive at a confident “yes” or “not yet.” The Remote & Outsourced Bookkeeping Decision ChecklistAnswer the following questions honestly. The more “yes” answers you have, the stronger the case for outsourcing. 1. Cost & Resources

If yes: Outsourced bookkeeping aligns well with your priorities.

2. Access to Expertise

If yes: A team-based outsourced model offers more depth than a single hire.

3. Scalability & Flexibility

If yes: Remote bookkeeping scales faster than in-house teams.

4. Technology Readiness

If yes: Your business is well-positioned for remote bookkeeping.

5. Control & Oversight Preferences

If yes: Outsourcing won’t reduce your sense of control.

6. Internal Complexity

If yes: Consider a hybrid or in-house model.

Decision Summary

The goal isn’t to follow trends—it’s to choose a model that supports your current reality and future plans.

If you’d like help applying this checklist to your specific business—industry, size, and growth goals—Confido can guide you through the decision. | ||||||||||||||||||

Section 10 — How Confido Supports Remote & Outsourced BookkeepingChoosing remote and outsourced bookkeeping is only half the decision. The real value comes from choosing the right partner—one that combines technology, process discipline, and deep compliance expertise. That’s where Confido stands apart. We don’t just “do the books.” We build reliable, scalable finance systems that support growth, compliance, and informed decision-making. Our Bookkeeping Services — Built for 2026 BusinessesConfido delivers end-to-end remote and outsourced bookkeeping services tailored to startups, SMEs, and international businesses. What We Handle

Whether you’re early-stage or scaling fast, our services flex with your business needs—without disruption.

Tools & Technology — Cloud-First, Secure, IntegratedRemote bookkeeping only works when technology is done right. Confido is cloud-native by design. Our Technology Stack Includes

This ensures:

You get transparency without micromanagement.

Compliance at the Core — Not an AfterthoughtMany bookkeeping providers stop at numbers. Confido goes further by embedding compliance into every workflow. Our Compliance-Focused Approach Covers

This reduces surprises at tax time and minimizes compliance risk—especially valuable for businesses operating across multiple jurisdictions.

A Partner, Not Just a VendorWhat clients value most about Confido is predictability and peace of mind:

Instead of reacting to problems, you stay ahead of them.

If you’re ready to move to a remote and outsourced bookkeeping model that actually works—without losing control or clarity—Confido is here to help. | ||||||||||||||||||

Section 11 — FAQs on Remote & Outsourced Bookkeeping in 2026Below are answers to the most common questions business owners ask when evaluating remote and outsourced bookkeeping in 2026. These address cost, security, suitability, and decision-making—helping you move from uncertainty to clarity.

What is remote and outsourced bookkeeping?Remote and outsourced bookkeeping means your financial records are maintained by an external professional team using cloud-based accounting software. The work is done off-site, but your data remains accessible in real time. Outsourcing typically involves a firm (not just an individual) that manages bookkeeping, reporting, and often compliance support on an ongoing basis.

Is outsourced bookkeeping safe in 2026?Yes—when done correctly. In 2026, reputable providers use:

In many cases, outsourced bookkeeping is more secure than in-house setups that rely on local files or single-user access.

What are the biggest benefits of remote bookkeeping?The most cited benefits include:

For startups and SMEs, these advantages often outweigh the drawbacks.

What are the disadvantages of outsourcing bookkeeping?The main limitations include:

These disadvantages matter most for large enterprises or businesses with complex internal controls.

How much does outsourced bookkeeping cost?Costs vary based on:

Most small businesses pay a predictable monthly fee, which is typically lower than the total cost of an in-house bookkeeper once salary and benefits are considered.

Is remote bookkeeping suitable for startups?Absolutely. Startups benefit significantly because:

Remote bookkeeping allows founders to stay focused on building the business, not managing admin.

Can outsourced bookkeepers handle compliance and taxes?Yes—many outsourced bookkeeping providers coordinate closely with tax and compliance functions. This includes:

Some firms, like Confido, integrate compliance directly into bookkeeping workflows.

How does remote bookkeeping work with QuickBooks?QuickBooks Online is one of the most widely used platforms for remote bookkeeping. It allows:

Outsourced bookkeepers work directly within your QuickBooks file while you retain full ownership and visibility.

When should a business NOT outsource bookkeeping?Outsourcing may not be ideal if:

In such cases, a hybrid or in-house model may work better.

How do I choose the right outsourced bookkeeping partner?Look for a provider that offers:

Most importantly, choose a partner who understands your growth goals—not just your numbers.

Still have questions about whether remote & outsourced bookkeeping is right for your business? Confido can help you evaluate your options with clarity and confidence. | ||||||||||||||||||

Section 12 — Final WordsRemote and outsourced bookkeeping in 2026 is no longer just a cost-saving alternative—it’s a strategic choice for businesses that value accuracy, flexibility, and control. As cloud technology matures and compliance requirements grow more complex, the way you manage your books has a direct impact on decision-making, scalability, and peace of mind. Throughout this guide, we’ve explored:

The key takeaway is simple: the right bookkeeping model depends on your business stage, complexity, and growth plans—not on outdated norms. For startups, SMEs, international businesses, and founder-led companies, remote and outsourced bookkeeping often delivers the best balance of expertise, cost efficiency, and scalability. With the right partner, you gain more than clean books—you gain confidence in your financial foundation. Work with Confido — Your Remote Bookkeeping PartnerConfido supports businesses with:

We help you move away from reactive bookkeeping and toward a structured, future-ready finance setup. 👉 Ready to explore whether remote & outsourced bookkeeping is right for you? Get in touch with Confido today. |