Bookkeeping for Startups in the U.S. : A Quick & Practical Guide (2026 Edition)

Introduction – Why Bookkeeping Matters for U.S. StartupsLaunching a startup in the U.S. is exciting—but it’s also operationally demanding. Between building your product, finding customers, and managing cash, bookkeeping often feels like something you can “figure out later.” For many founders, that’s a costly assumption. In the U.S., bookkeeping isn’t just about tracking expenses. It’s the backbone of compliance, decision-making, and credibility. From day one, your startup is expected to maintain accurate financial records that align with tax rules, payroll obligations, and reporting standards set by the Internal Revenue Service and state agencies. Even early mistakes—misclassified expenses, missing receipts, unreconciled accounts—can compound quickly. For first-time founders, especially those new to the U.S. market, the challenge is clarity. This Quick Guide (2026 Edition) is designed to answer those questions in plain English—without accounting jargon or unnecessary theory. Whether you’re bootstrapping, pre-revenue, or starting to scale, proper bookkeeping helps you:

Most importantly, good bookkeeping gives founders confidence. Instead of reacting at tax time or scrambling before fundraising conversations, you’re operating with visibility and control. Throughout this guide, we’ll break down startup bookkeeping basics, common pitfalls, tools like QuickBooks, and when it makes sense to get professional help—so you can focus on building your startup, not second-guessing your numbers. If you’re unsure whether your current bookkeeping setup is helping or holding you back, you can always start with a quick conversation with us!

|

What Bookkeeping Means for Startups (in Simple Terms)At its simplest, bookkeeping is the process of recording, organizing, and maintaining your startup’s financial activity—so you always know what you earned, what you spent, and where you stand financially. For startups, bookkeeping is not about complex accounting theory. It’s about building a clean, reliable financial record from day one. Bookkeeping vs. Accounting (Plain English)Founders often use these terms interchangeably, but they’re not the same:

Think of bookkeeping as the foundation. If it’s weak or messy, everything built on top—taxes, reporting, fundraising—becomes harder and riskier. What Bookkeeping Looks Like in a Startup ContextFor a U.S. startup, bookkeeping typically means:

Most startups do this using cloud tools like QuickBooks, which allow founders and finance teams to access real-time data without manual spreadsheets. A Simple ExampleImagine a SaaS startup in its first year:

Bookkeeping ensures each of these is:

Without this structure, founders often rely on bank balances or gut instinct—both of which are unreliable indicators of financial health. Why “Simple” Bookkeeping Is Still CriticalEven at an early stage, startups need bookkeeping to:

Good bookkeeping doesn’t slow startups down—it reduces uncertainty so decisions are faster and better informed. If bookkeeping feels unclear or overly technical, that’s common—especially for first-time founders. A quick conversation with us can help you clarify what’s required at your stage.

|

U.S. Bookkeeping Basics Every Startup Must KnowU.S. bookkeeping has a few non-negotiables. These aren’t advanced accounting concepts—they’re foundational rules that every startup operating in the U.S. must get right early. Understanding them helps you avoid compliance issues, reduce cleanup later, and build investor-ready books. Separate Business and Personal Finances (From Day One)This is the most common—and costly—early mistake. U.S. startups are expected to:

Mixing personal and business expenses creates confusion, complicates taxes, and raises red flags during audits or due diligence. Practical tip:

Choose a Bookkeeping Method: Cash vs. AccrualStartups in the U.S. typically use one of two methods: Cash Basis

Accrual Basis

Many investors and lenders prefer accrual-based financials because they reflect true performance, not just bank timing. Rule of thumb:

Categorize Transactions CorrectlyEvery transaction should be categorized consistently:

Accurate categorization ensures:

This is where tools like QuickBooks help—but only if categories are set up properly.

Reconcile Accounts RegularlyReconciliation means matching your bookkeeping records to actual bank and credit card statements. Why it matters:

At a minimum, startups should reconcile monthly. High-volume startups may need weekly reviews.

Maintain Clean, Basic Financial ReportsEven very early-stage startups should generate:

These reports are essential for:

They’re also what tax authorities like the Internal Revenue Service expect your records to support.

Document EverythingU.S. bookkeeping is documentation-driven. You should retain:

Cloud tools make this easier, but consistency matters more than software choice. If you’re unsure whether your current setup meets U.S. expectations, it’s better to review early than clean up later. You can talk through your basics here!

|

Common Bookkeeping Mistakes Startups MakeMost bookkeeping problems startups face aren’t caused by complexity—they’re caused by small, repeated mistakes made early and left uncorrected. These issues often stay hidden until tax season, fundraising, or a compliance notice forces attention. Below are the most common bookkeeping mistakes U.S. startups make—and why avoiding them early matters. Mixing Personal and Business ExpensesThis is the single most frequent error among early-stage founders. Common scenarios include:

Why it’s risky:

Even if it feels harmless early on, this habit becomes harder to unwind as transaction volume grows.

Relying Only on Bank BalanceMany founders judge financial health by checking their bank balance. The problem?

Without proper bookkeeping, startups miss:

Bookkeeping translates raw cash movement into usable financial insight.

Falling Behind on UpdatesStartups move fast—and bookkeeping often lags behind. When books aren’t updated regularly:

Trying to “catch up later” almost always costs more time and money than keeping books current.

Incorrect Expense CategorizationMisclassifying expenses is common, especially when founders handle bookkeeping themselves. Examples:

Why this matters:

Accounting software like QuickBooks helps—but only when categories are set up and used correctly.

Ignoring Payroll and Tax TimingPayroll and taxes are where mistakes become expensive. Startups often:

These errors can trigger penalties from the Internal Revenue Service and state agencies—even if the mistake was unintentional.

Waiting Too Long to Get HelpMany founders delay professional support until:

By then, cleanup is more complex—and more expensive. Getting help earlier often:

If any of these mistakes feel familiar, it’s a good moment to pause and assess your setup. A short conversation can help you identify risks early.

|

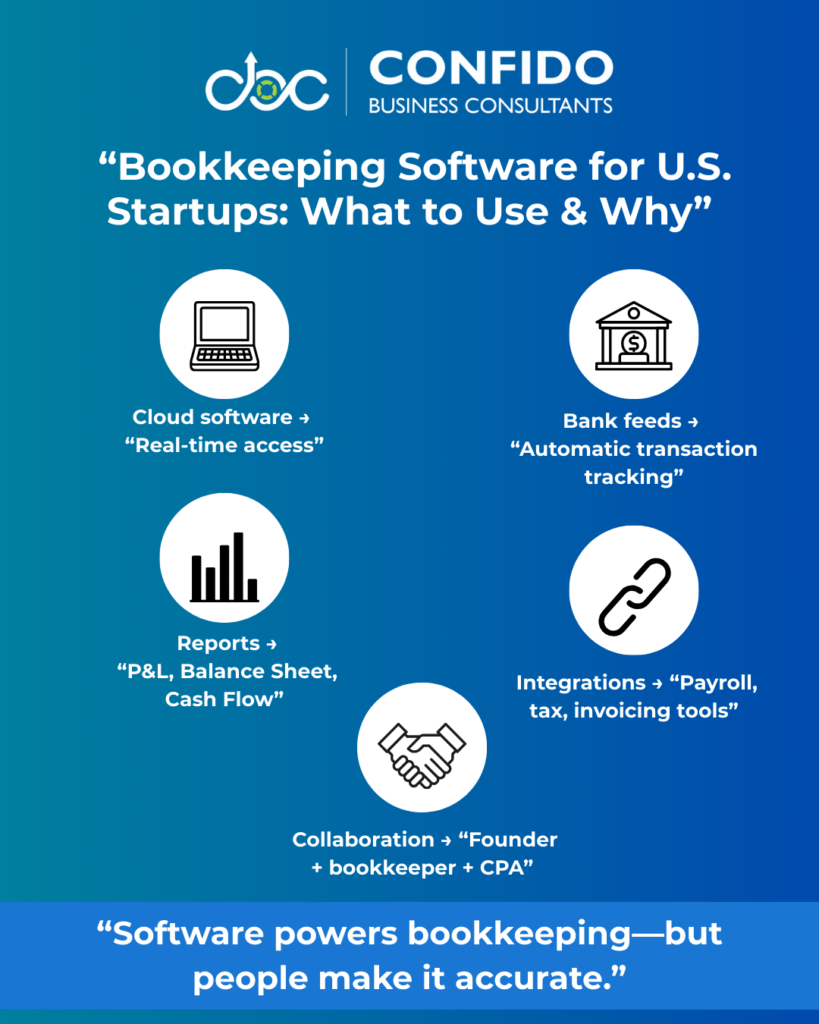

Bookkeeping Software for U.S. Startups (QuickBooks, etc.)For most U.S. startups, bookkeeping software is the engine behind day-to-day financial tracking. The right tool doesn’t just record transactions—it makes compliance easier, reporting clearer, and collaboration smoother as your startup grows. The key is choosing software that fits your stage, complexity, and future plans. Why Most U.S. Startups Use Cloud-Based SoftwareModern startups rarely use spreadsheets alone—and for good reason. Cloud-based bookkeeping tools allow you to:

This is especially important for U.S. startups dealing with taxes, payroll, and investor reporting.

QuickBooks: The Most Common ChoiceQuickBooks Online is the most widely used bookkeeping platform among U.S. startups. Why startups choose QuickBooks:

For many startups, QuickBooks becomes the single source of truth for financial data—especially as they move toward accrual accounting or fundraising.

Other Popular Options Startups ConsiderWhile QuickBooks dominates, some startups explore alternatives depending on needs:

Each tool has strengths, but the best software is the one set up correctly and used consistently.

What Software Can—and Can’t—Do for YouBookkeeping software is powerful, but it’s not a replacement for financial judgment. Software can:

Software cannot:

This is why many startups combine software with professional support—especially as complexity increases.

Choosing the Right Tool for Your Startup StageEarly-stage / pre-revenue startups

Scaling startups

Funded or international startups

The wrong tool—or the right tool used incorrectly—can create more confusion than clarity.

If you’re unsure whether your current software setup is helping or hurting your bookkeeping, a quick review can make a big difference!

|

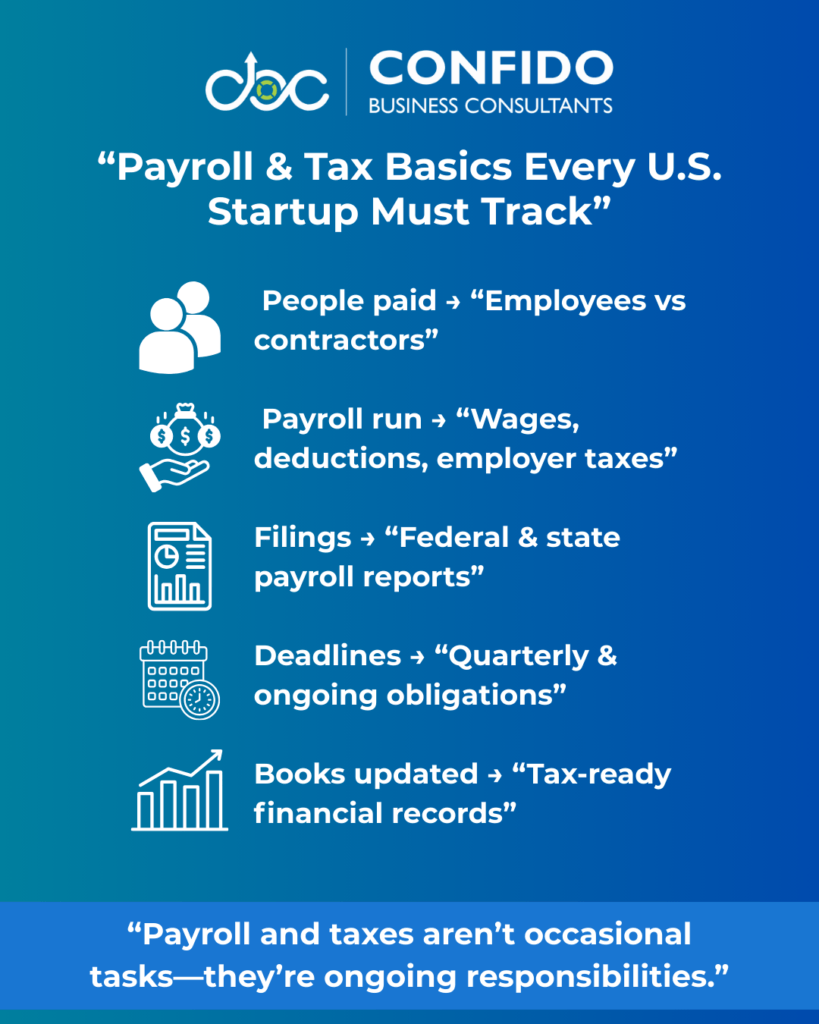

Payroll and Tax Considerations for StartupsPayroll and taxes are where bookkeeping stops being “administrative” and starts becoming high-risk for U.S. startups. Even small mistakes here can trigger penalties, interest, or compliance notices—regardless of how early-stage your company is. Understanding the basics early helps founders avoid surprises and build a clean financial track record. Payroll Isn’t Optional Once You Have PeopleThe moment your startup pays:

you’ve entered payroll territory. Payroll bookkeeping typically involves:

U.S. payroll rules are strict, and enforcement is real—especially from the Internal Revenue Service and state agencies.

Employee vs Contractor Classification MattersStartups often rely heavily on contractors—but misclassification is a common and expensive mistake. Why it matters:

Bookkeeping must clearly reflect:

This isn’t just an HR issue—it directly affects your books and tax filings.

Startup Taxes Don’t Happen Just Once a YearMany founders assume taxes are annual. In reality, startups deal with ongoing tax obligations, including:

Good bookkeeping ensures these obligations are:

Falling behind doesn’t just create stress—it compounds costs.

How Bookkeeping Supports Tax ReadinessWhen bookkeeping is done properly:

This makes collaboration with your CPA or tax advisor significantly smoother—and reduces the risk of last-minute corrections. Tools like QuickBooks often integrate directly with payroll and tax platforms, but integration alone isn’t enough without oversight.

Why Startups Struggle HerePayroll and tax issues usually arise because:

These problems tend to surface during growth—exactly when startups can least afford disruption.

|

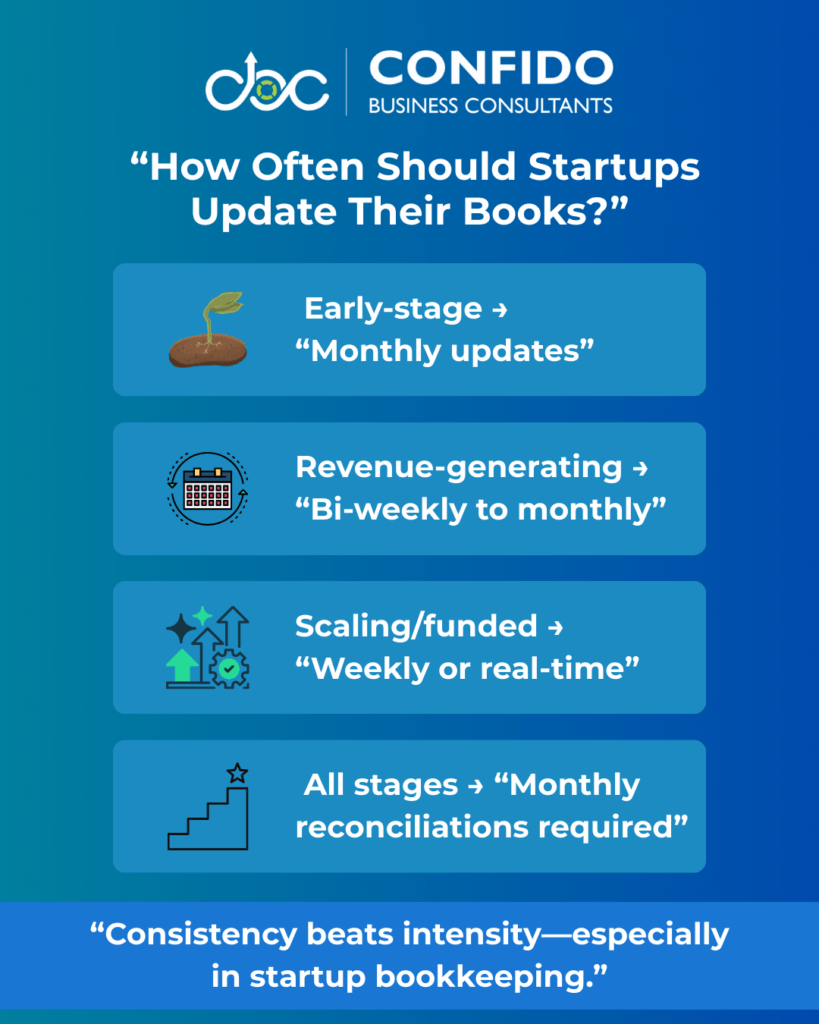

How Often Startups Should Update Their BooksOne of the most common questions founders ask is: “How often do I really need to update my books?” The short answer: more often than you think—but not obsessively. The right update frequency depends on your startup’s stage, transaction volume, and goals. What matters most is consistency, not perfection. Why Update Frequency MattersBookkeeping isn’t just about record-keeping—it’s about decision-making. When books are updated regularly:

When updates lag:

Recommended Update Cadence by Startup StageEarly-Stage / Pre-Revenue Startups

Monthly updates are usually sufficient at this stage—provided nothing is missed.

Revenue-Generating Startups

Delaying updates beyond a month can obscure profitability trends.

Scaling or Funded Startups

At this stage, near real-time bookkeeping supports faster, better decisions.

Monthly Reconciliation Is Non-NegotiableRegardless of size, bank and credit card reconciliations should happen at least monthly. Reconciliation ensures:

Software like QuickBooks makes reconciliation easier—but it still requires review.

The “Catch-Up Later” TrapMany founders plan to “catch up” on bookkeeping later. This almost always leads to:

Regular updates are less about effort—and more about avoiding future disruption.

A Practical Rule of ThumbAsk yourself:

If the answer is no, it’s time to increase the update frequency.

|

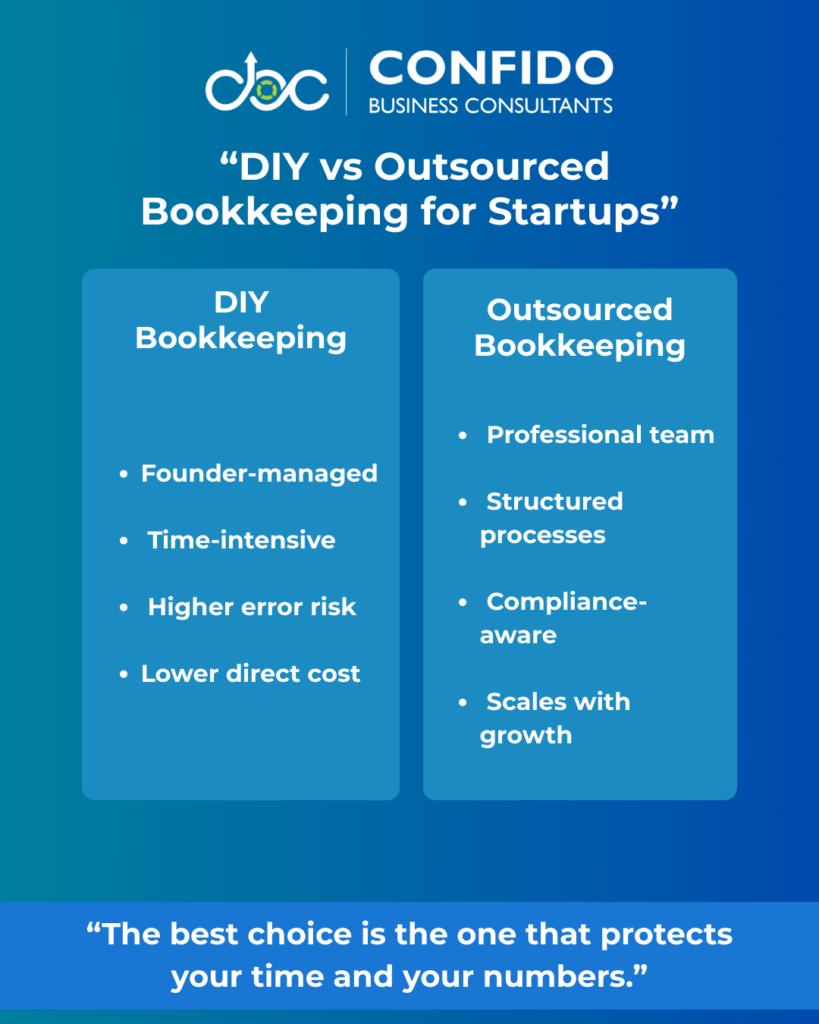

DIY Bookkeeping vs Outsourcing for StartupsAt some point, nearly every startup founder faces this question: “Should we handle bookkeeping ourselves, or outsource it?” There’s no one-size-fits-all answer. The right choice depends on your stage, complexity, risk tolerance, and how you want to spend your time as a founder. This section lays out the trade-offs clearly—without pushing you in either direction. DIY Bookkeeping: When Founders Handle It ThemselvesMany startups begin with DIY bookkeeping, especially in the early days. Why founders choose DIY:

What DIY usually involves:

For very early-stage startups, this can work—if books are updated regularly and kept clean.

The Hidden Costs of DIY BookkeepingDIY often looks cheaper on paper, but it comes with trade-offs founders underestimate. Common challenges include:

As transaction volume grows, DIY bookkeeping becomes harder to sustain without cutting corners.

Outsourced Bookkeeping: How It Works for StartupsOutsourced bookkeeping means working with a professional team that manages your books on an ongoing basis—using your accounting software and structured processes. What outsourcing typically provides:

Most startups still retain full access and visibility—they’re delegating execution, not control.

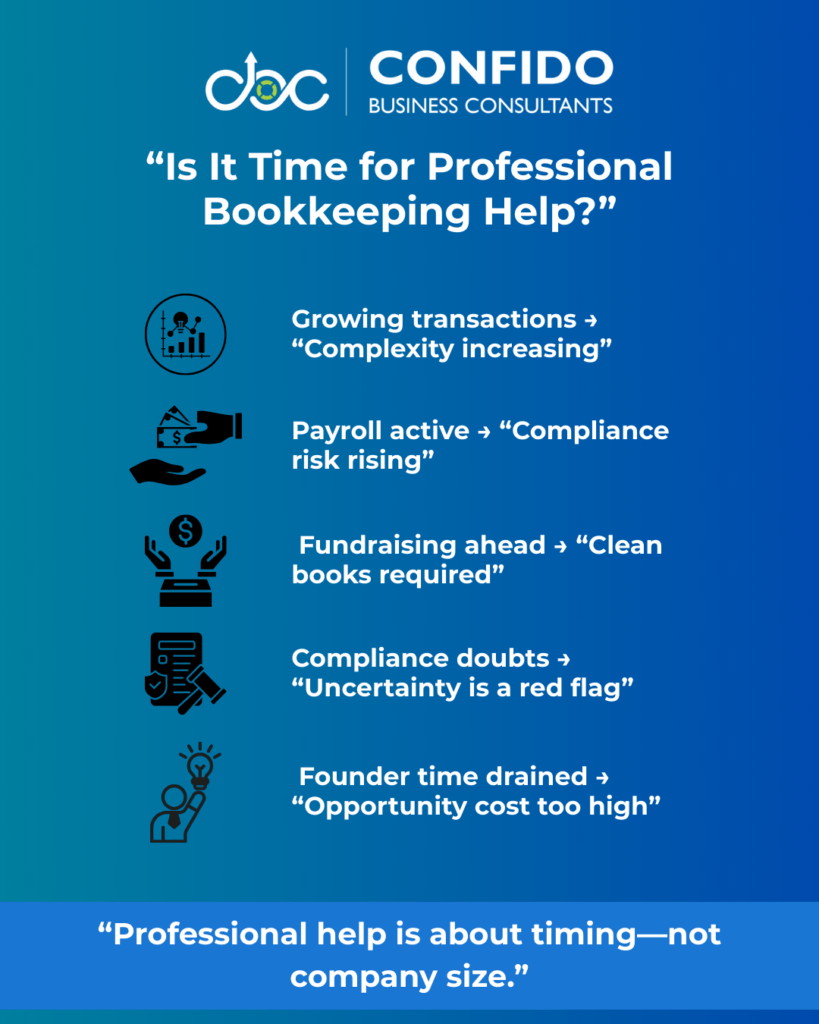

When Outsourcing Starts to Make SenseOutsourcing often becomes the better option when:

At this point, the cost of errors or founder time usually outweighs the cost of professional support.

DIY vs Outsourcing: A Simple ComparisonDIY bookkeeping works best when:

Outsourced bookkeeping works best when:

Many startups also adopt a hybrid approach—DIY early, then outsource as complexity increases.

|

When Startups Should Get Professional HelpMany founders wait too long before bringing in professional bookkeeping support—not because they don’t value it, but because they’re unsure when it’s actually necessary. The reality is, getting help isn’t a sign your startup is “big enough.” It’s a sign you’re protecting your growth. Here are the most common signals that it’s time to consider professional help. Your Transaction Volume Is GrowingWhat felt manageable with a handful of expenses quickly becomes complex once your startup has:

As volume increases, so does the risk of missed entries, misclassifications, and reconciliation issues. Professional bookkeeping introduces structure before complexity turns into chaos.

You’re Running Payroll or Paying Contractors RegularlyPayroll is one of the clearest tipping points. Once your startup starts paying:

the compliance burden increases significantly. Errors here can lead to penalties, back payments, and reporting issues. Professional support helps ensure payroll entries, filings, and records align properly with your books—month after month.

You’re Preparing for Funding, Loans, or PartnershipsInvestors and lenders don’t just look at your idea—they look at your numbers. If you’re:

you’ll be asked for clean financial reports. Messy or inconsistent books raise doubts and slow down due diligence. Professional bookkeeping helps you present:

You’re Unsure About ComplianceIf you’ve ever wondered:

that uncertainty is a signal in itself. Professional help reduces guesswork by embedding compliance awareness into daily bookkeeping—rather than reacting after a problem arises.

Bookkeeping Is Consuming Founder TimeFounder time is one of a startup’s most valuable resources. If bookkeeping:

it’s no longer serving its purpose. Outsourcing execution allows founders to stay informed without being buried in admin.

Professional Help Doesn’t Mean Losing ControlA common fear is losing visibility or ownership. In reality, good bookkeeping support does the opposite:

It’s about delegating execution, not accountability.

|

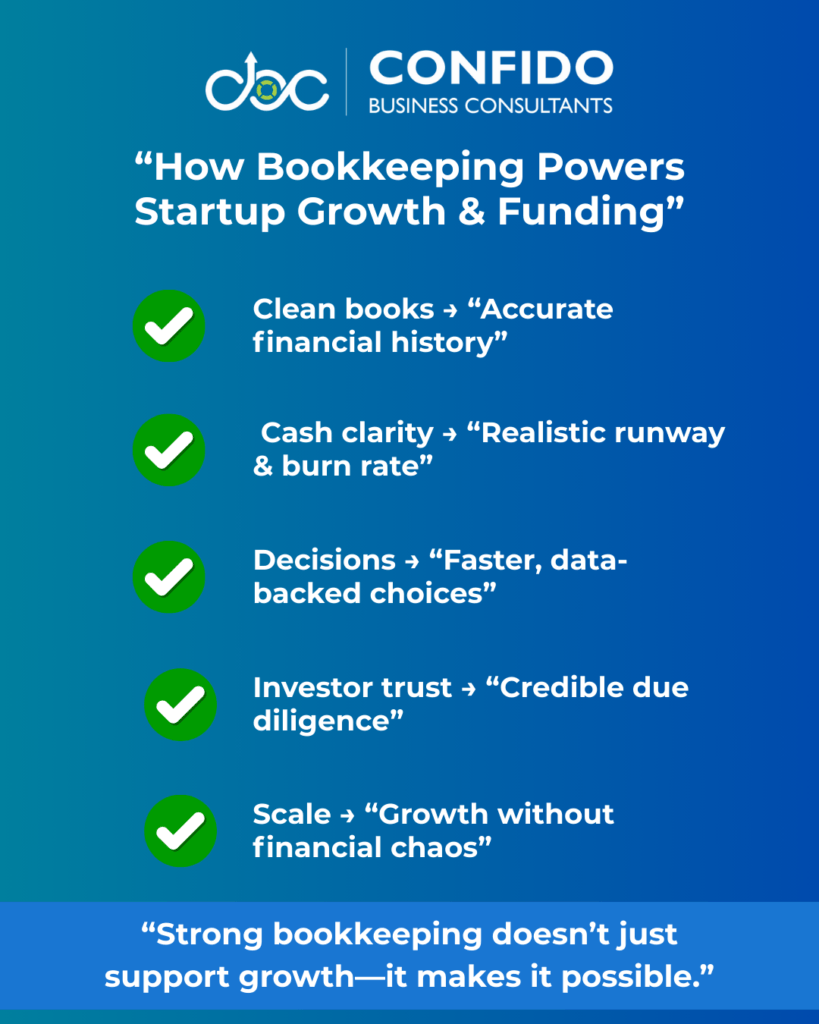

How Proper Bookkeeping Supports Growth & FundingFor many startups, bookkeeping is treated as a back-office task—something that exists to “keep things compliant.” In reality, proper bookkeeping is a growth enabler. It directly influences how confidently you can scale, raise capital, and make strategic decisions. Here’s how clean, consistent bookkeeping supports startup growth and funding in practical terms. Gives You Clear Visibility Into Cash and RunwayGrowth decisions depend on one question: How long can we operate at our current pace? Proper bookkeeping provides:

Without this, founders often overestimate available cash by looking only at bank balances—ignoring upcoming expenses, payroll, and taxes. Clean books turn guesswork into clarity.

Enables Smarter, Faster DecisionsWhen bookkeeping is up to date, founders can answer critical questions quickly:

Instead of waiting for end-of-quarter surprises, decisions are based on current data—supported by reliable Profit & Loss and cash flow reports.

Builds Credibility With Investors and LendersInvestors don’t expect perfection—but they do expect discipline. During due diligence, they typically look for:

Startups with messy or incomplete books often face delays, extra scrutiny, or reduced confidence—even if the underlying business is strong. Proper bookkeeping signals that the company is operationally sound and ready to scale.

Supports Fundraising ReadinessAs fundraising approaches, bookkeeping becomes the foundation for:

Clean historical data makes forecasts more credible. It also allows founders to respond confidently to investor questions—without scrambling to “clean things up” at the last minute.

Reduces Risk During GrowthGrowth introduces complexity:

Proper bookkeeping ensures that as you scale:

This reduces the risk of painful corrections during critical growth phases.

Growth Without ChaosThe startups that scale smoothly aren’t the ones doing more bookkeeping—they’re the ones doing it properly. Good bookkeeping creates:

|

FAQs: Bookkeeping for Startups in the U.S.Below are clear, founder-friendly answers to the most common questions startups have about bookkeeping in the U.S. These address legal requirements, cost, timing, tools, and risk—so you can move forward with clarity, not guesswork. What bookkeeping is legally required for startups in the U.S.?U.S. startups are required to maintain accurate and complete financial records that support tax filings, payroll reporting, and compliance with federal and state regulations. While there’s no single “bookkeeping law,” authorities such as the Internal Revenue Service expect businesses to keep records of income, expenses, payroll, and supporting documents for several years. At a minimum, startups must be able to substantiate:

When should a startup start bookkeeping?Immediately. Bookkeeping should begin as soon as your startup:

Delaying bookkeeping often leads to cleanup work later, which is more expensive and stressful than maintaining records from day one.

What’s the difference between bookkeeping and accounting for startups?In simple terms:

Bookkeeping ensures transactions are accurate and organized. Accounting uses that data for tax filing, forecasting, and strategic advice. Startups need both, but bookkeeping always comes first.

Do U.S. startups need QuickBooks?No software is legally required, but many U.S. startups use QuickBooks because it:

The tool matters less than how well it’s set up and maintained.

How much does bookkeeping cost for a startup?Costs vary based on:

Early-stage startups may spend very little if books are simple, while growing startups often invest in monthly professional support. In most cases, the cost of proper bookkeeping is far lower than the cost of errors, penalties, or lost founder time.

Can founders handle bookkeeping themselves?Yes—many founders do in the early stages. However, DIY bookkeeping works best when:

As complexity increases, founder-managed bookkeeping often becomes inefficient and risky.

When should a startup outsource bookkeeping?Startups typically consider outsourcing when:

Outsourcing execution doesn’t mean losing visibility—it means gaining accuracy and consistency.

What happens if bookkeeping is done incorrectly?Incorrect bookkeeping can lead to:

Most problems aren’t caused by intent—but by delay and inconsistency.

|

Conclusion: A Simple Bookkeeping Foundation for U.S. StartupsBookkeeping doesn’t need to be complicated to be effective—but it does need to be consistent, accurate, and aligned with U.S. expectations. For startups, good bookkeeping is less about compliance checklists and more about clarity:

Throughout this guide, we’ve covered:

The takeaway is simple: bookkeeping works best when it quietly supports your startup instead of constantly demanding attention. You don’t need a full finance team on day one. You do need a structure that grows with you—one that keeps your books clean, your compliance on track, and your time focused on building the business.

|