Introduction: Why Compliance Calendars Are Crucial for U.S. Small Businesses in 2026Running a business in the United States comes with a long list of recurring federal tax deadlines — quarterly estimated payments, annual filings, payroll submissions, information returns, and more. Missing even one of these can result in penalties, interest charges, IRS notices, or delayed refunds. And in 2026, with new reporting obligations like Beneficial Ownership Information (BOI) now fully in force, staying compliant has never been more important. That’s why small business owners, founders, CFOs, bookkeepers, and international entrepreneurs entering the U.S. market actively search for a clear, reliable, month-by-month compliance calendar they can depend on throughout the year. This guide gives you exactly that. It’s designed to be:

Whether you’re a small business owner handling your own filings, a startup preparing for your first U.S. tax year, or an established company wanting a clean compliance workflow, this calendar acts as your 2026 federal compliance roadmap. Need help with IRS filings, payroll tax deadlines, or compliance reminders? Confido ensures nothing slips through the cracks — ever. Get in touch to stay compliant year-round.

|

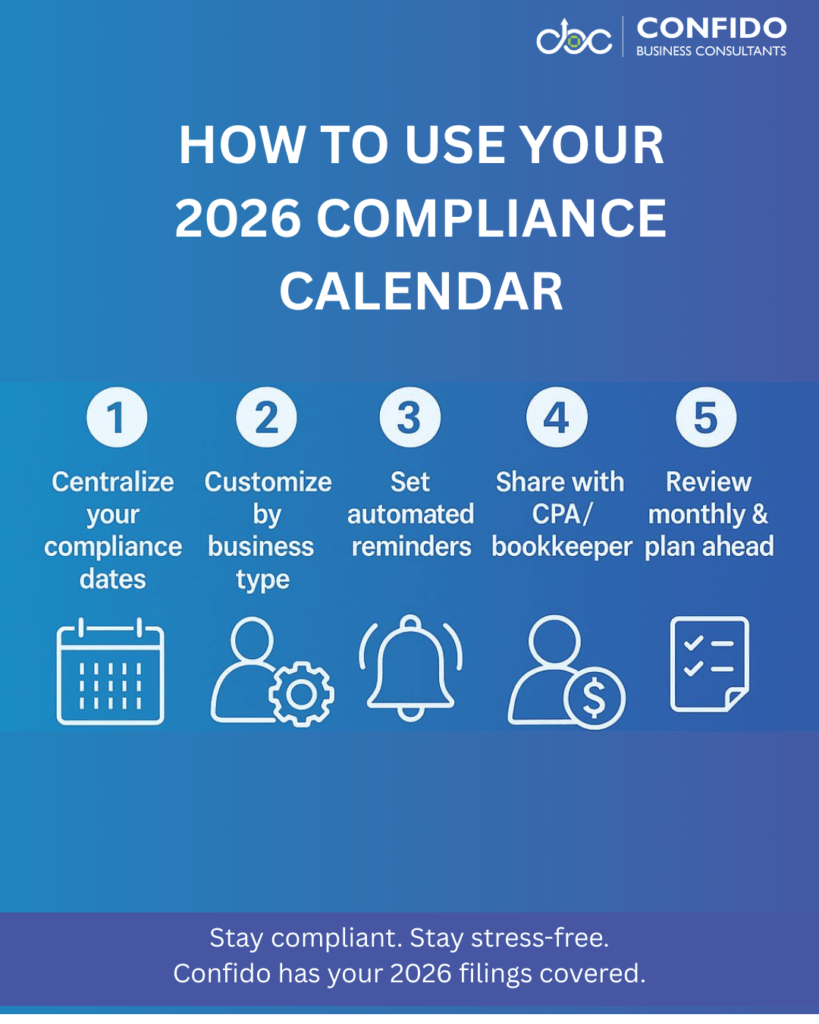

How to Use This Calendar: Quick Guide on Applying It to Your OperationsA compliance calendar is only helpful if you know exactly how to integrate it into your day-to-day workflow. Instead of scanning through dates once and forgetting about them, use this section to make the calendar part of your financial routine. Here’s how to get the most value from your 2026 federal compliance calendar: Create a Centralized Compliance HubWhether you’re a solopreneur or a growing business, keep all compliance timelines in one place — your accounting software, project management tool, or a shared drive your team can access. Tools you can use:

This ensures everyone stays aligned and deadlines are never overlooked. Customize the Calendar to Your Business TypeNot every deadline in this guide applies to every business. Before you begin, identify your category:

Mark only the deadlines relevant to your entity — this transforms the calendar from “general” to “tailored”. Set Automated Reminders for Every Key DeadlineIRS penalties often happen not because businesses don’t know the rules, but because they simply forget. Set reminders for:

Schedule reminders 10 days before and 2 days before the due date — your future self will thank you. Coordinate Your Calendar With Your CPA or BookkeeperThis is where most businesses fail — they track dates internally but don’t communicate them with the person actually filing. Share this 2026 calendar with:

This eliminates misalignment and ensures your filings are done correctly and on time. Integrate It Into Your Monthly Financial RoutineThe best way to avoid last-minute panic? Monthly compliance check-ins. At the start of every month:

This simple habit reduces errors, missed filings, and IRS notices. Use It as a Planning Tool — Not Just a Reminder ToolThis calendar helps you:

In other words, you don’t just avoid penalties — you stay financially organized. If you want this compliance calendar synced with reminders, filing support, and monthly bookkeeping — Confido handles everything end-to-end so you never miss a deadline again. |

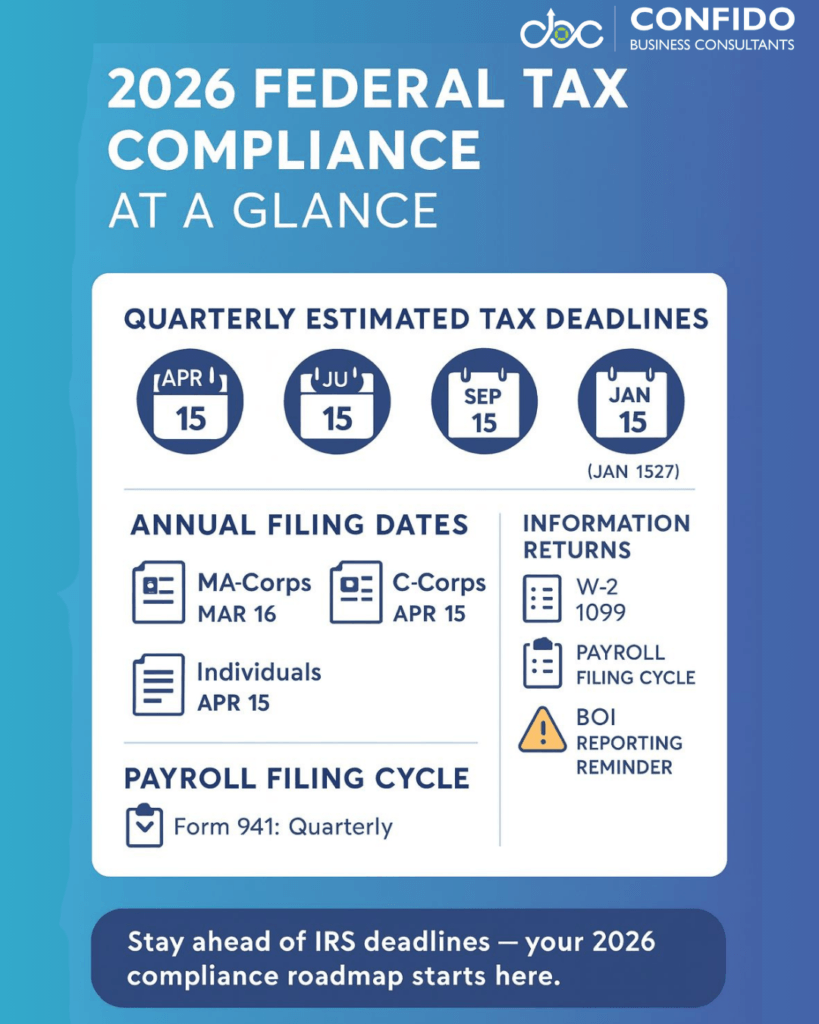

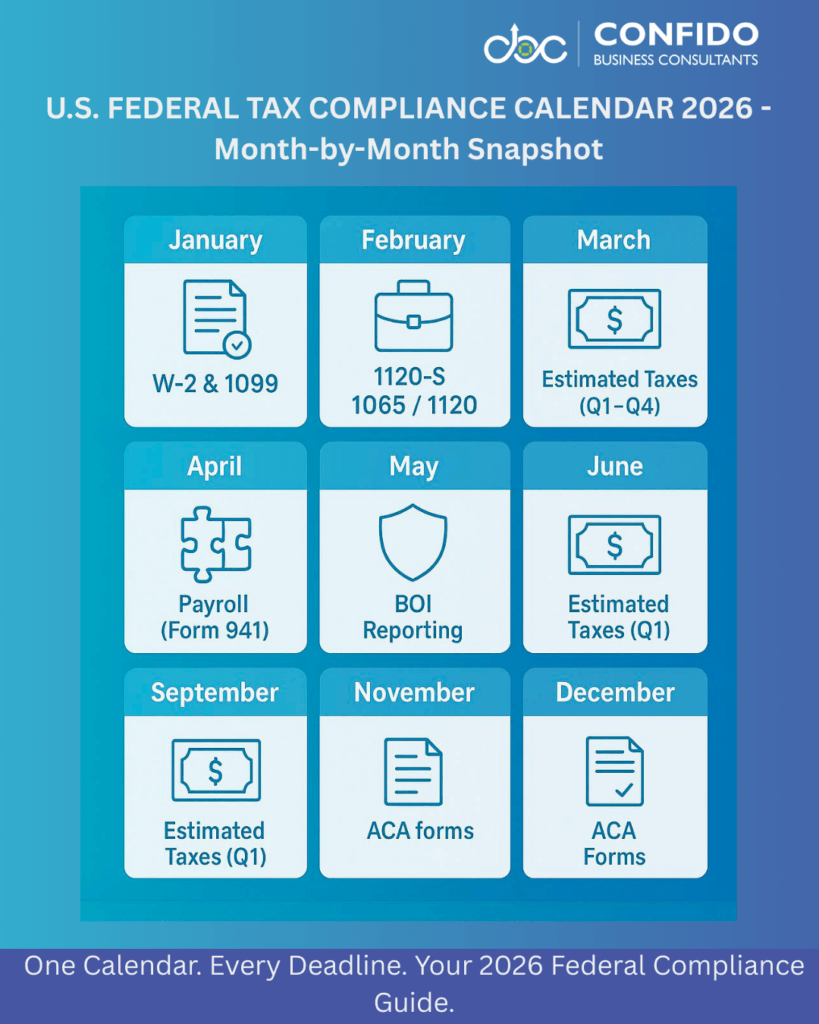

Month-by-Month Federal Compliance Calendar 2026This is the heart of US Tax Compliance 2026 — a complete breakdown of every major federal filing deadline U.S. small businesses must track. Each month includes:

January 2026 – Q4 Filings + Year-End CloseJanuary 15 — Q4 Estimated Tax Payment (Individuals, LLCs, Some S-Corp Shareholders)Applies to:

IRS Form: None (paid via EFTPS). Prepare:

January 31 — Form 941 (Quarterly Payroll Filing) for Q4 2025Applies to: Employers with payroll. January 31 — FUTA Form 940 (Annual Federal Unemployment Tax Return)Applies to: All employers. January 31 — Furnish W-2 Forms to EmployeesApplies to: Employers. January 31 — Furnish 1099-NEC to ContractorsApplies to: Any business paying $600+ to non-employees. Don’t stress if you’re juggling W-2s, 1099s, and payroll filings. Confido prepares and files everything on time — with zero errors. Talk to us to automate your January workload.February 2026 – Information Return Filings (W-2, 1099, ACA)February 1 — File W-2 and W-3 with the SSAApplies to: Employers. February 1 — File 1099-NEC with the IRSApplies to: Businesses paying contractors. February 28 — ACA Forms 1094-B, 1095-B (Paper Filing)Applies to:

February 28 — ACA Forms 1094-C, 1095-C Paper Filing (Applicable Large Employers – 50+ FTE)💡 Note: Electronic filing deadline is in March (below). March 2026 – S-Corp & Partnership DeadlinesMarch 2 — ACA Forms Electronic Filing (1095-B/C)If filing electronically, this is the final deadline. March 16 — S-Corp Return Deadline (Form 1120-S) + Schedule K-1sApplies to: S-Corporations. March 16 — Partnership Return Deadline (Form 1065) + K-1sApplies to: LLCs taxed as partnerships. March 16 — Extension Deadline (Form 7004)Allows extension till September. 📌 Preparation Tip: April 2026 – Individual & C-Corp Filings + Q1 Estimated TaxApril 15 — Individual Income Tax Return (Form 1040)Applies to:

April 15 — C-Corporation Return (Form 1120)April 15 — Q1 Estimated Tax PaymentsApplies to:

April 15 — Form 7004 Filing for Corporate ExtensionsExtends deadline to October.

June 2026 – Q2 Estimated TaxesJune 15 — Q2 Estimated Tax Payment DueApplies to: Individuals, LLCs, partnerships, S-Corp shareholders. 📌 Preparation Tip: September 2026 – Extended Returns + Q3 Estimated PaymentsSeptember 15 — Extended S-Corp and Partnership Returns DueForms:

September 15 — Q3 Estimated Tax Payment DueApplies to:

📌 Preparation Tip: October 2026 – Final Extensions (Individuals, C-Corps)October 15 — Extended Individual Returns Due (Form 1040)October 15 — Extended C-Corp Returns Due (Form 1120)Ongoing 2026 – Payroll, BOI/UBO, and Labor ComplianceQuarterly Payroll Filing (Form 941)Deadlines:

BOI / UBO Reporting (FinCEN)New requirement (Corporate Transparency Act). Federal Labor ComplianceApplies to employers:

|

Common Mistakes to Avoid (Late Filing, Forgetting Estimated Payments, etc.)Even with a clear compliance calendar, many small businesses still face penalties each year — not because they don’t understand the rules, but because small, preventable oversights pile up over time. Here are the most frequent compliance mistakes and how to avoid them in 2026. Missing Quarterly Estimated Tax PaymentsOne of the leading causes of IRS penalties is simply forgetting estimated payments in April, June, September, and January of the following year. Why it matters:

How to avoid it: Filing Extensions Without Making Extension PaymentsMany business owners think filing an extension delays their tax payment. It doesn’t. You must pay even if you haven’t filed yet. Mistake leads to:

Fix: Forgetting to File or Furnish Information Returns (W-2, 1099)W-2s and 1099-NECs carry strict penalties if issued late. Common issues:

Avoid it: Overlooking Annual Employer Filings (FUTA, ACA, BOI Reporting)FUTA (Form 940), ACA forms, and new BOI reporting requirements often slip through the cracks. Why: Not Reconciling Books Before FilingRushing into a tax return without accurate books leads to:

Fix: Depending on One Person Internally for All ComplianceWhen the only finance person goes on leave or resigns, deadlines are missed. Risk areas:

Alternative: Confusing Payroll Filing CyclesPayroll filings follow strict cycles (like Form 941 quarterly filing). Even minor delays lead to penalties. Fix: Assuming Tax Software Handles Everything AutomaticallySoftware helps — but it does not:

You still need oversight. If managing deadlines, payroll filings, and estimated taxes feels overwhelming, Confido can take compliance off your shoulders completely. Stay penalty-free and IRS-ready with Confido’s year-round compliance support. Talk to us today.

|

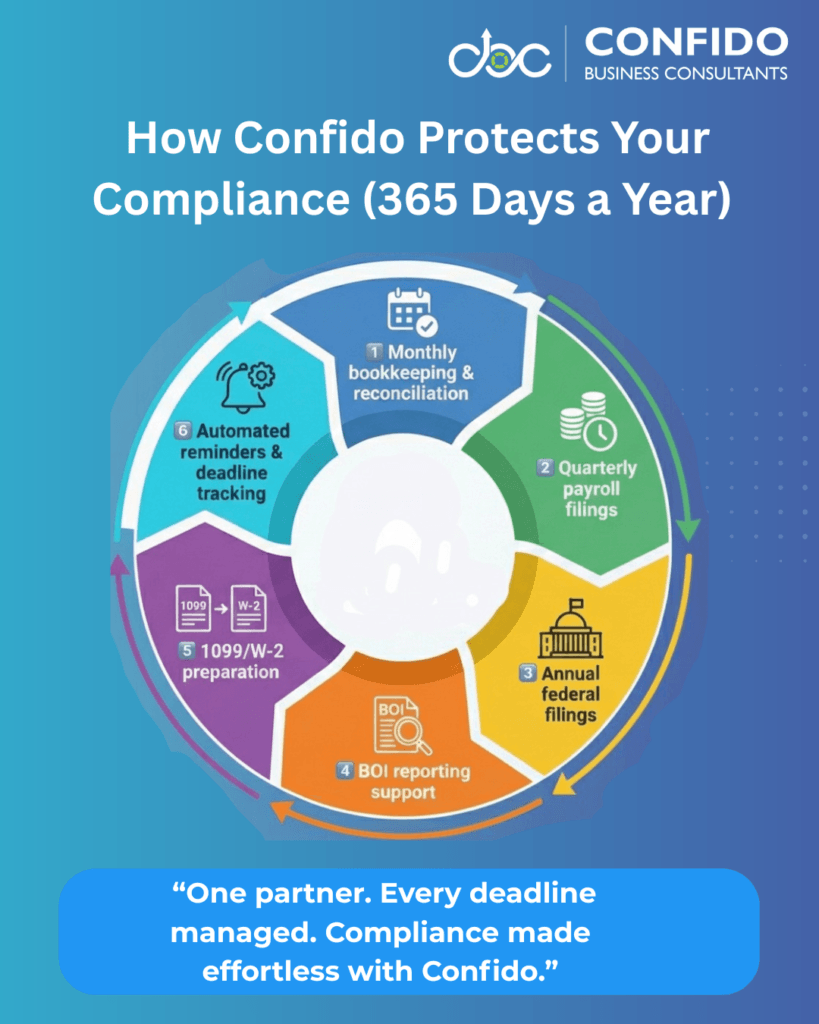

How Confido Helps You Stay Compliant Year-RoundA federal compliance calendar is powerful — but only when paired with consistent bookkeeping, accurate records, and proactive reminders. That’s where most small businesses struggle. Late filings, IRS notices, missing documents, or incorrect payroll forms usually happen because compliance isn’t monitored consistently. Confido’s compliance-first bookkeeping model is built to ensure you never miss a federal deadline again, no matter how busy your operations get. Proactive Deadline Tracking & Automated RemindersInstead of reacting to deadlines at the last minute, Confido tracks every 2026 due date — from quarterly payroll filings to annual returns — and sends reminders before anything is due. What this means for you:

Monthly Bookkeeping That Keeps Your Data IRS-ReadyAccurate filings begin with accurate books. Confido updates and reconciles your books every month so your records are always clean, organized, and audit-ready. You get:

Monthly reconciliation ensures quarterly and annual filings are done correctly — not rushed at year-end. End-to-End Payroll CompliancePayroll is one of the biggest compliance risk areas for small businesses. Confido handles:

No more worrying about penalties or mismatched payroll numbers. Federal Returns & Extensions Filing SupportFrom partnerships (1065) to S-Corps (1120-S), C-Corps (1120), and individual schedules (1040), Confido coordinates with your CPA or handles the data prep required for accurate federal filings. We help you:

BOI (Beneficial Ownership Information) Reporting AssistanceWith BOI reporting now mandatory under the Corporate Transparency Act, Confido ensures your business stays compliant by:

This protects your business from fines up to $10,000 for non-compliance. ACA, 1099, and W-2 Information Return PreparationConfido ensures:

We eliminate the operational chaos that typically happens in January and February. Secure Cloud Systems & Audit-Ready DocumentationAll your compliance documents are stored securely in an encrypted cloud structure with:

You always know where your financial documents live — and can access them anytime.

|

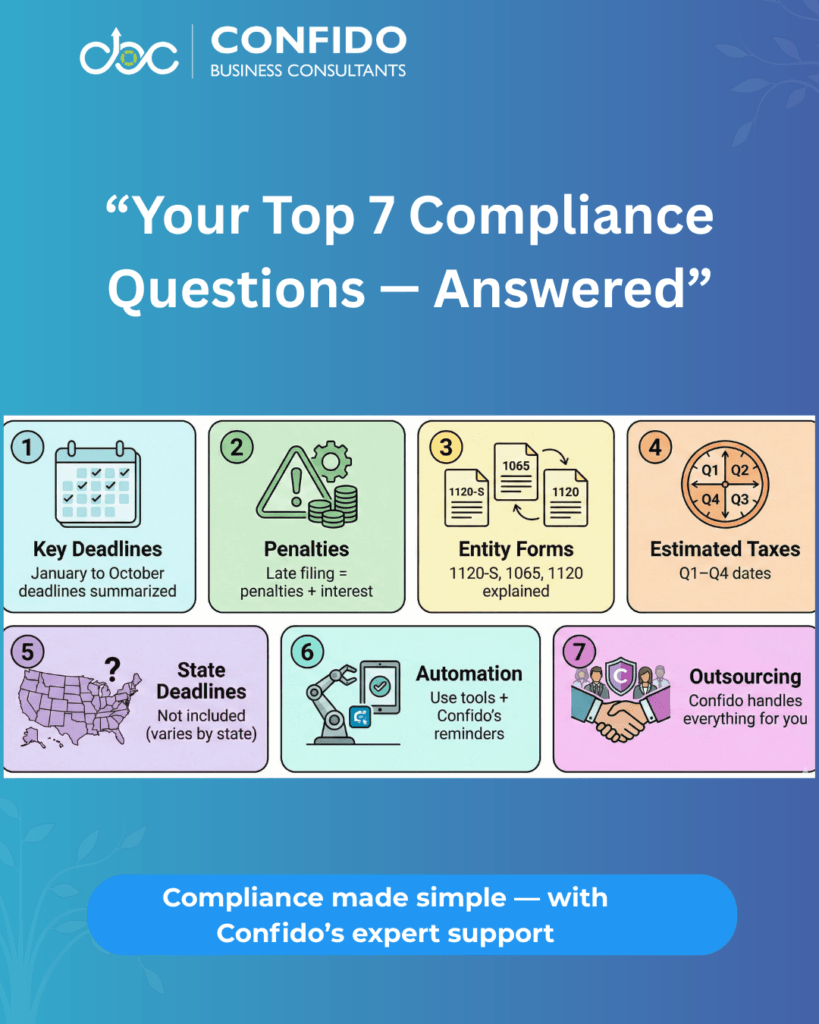

FAQs on US Tax Compliance Calendar 2026 for Small BusinessesWhat are the key federal tax deadlines for 2026? The major federal deadlines include:

This blog includes all major 2026 deadlines in a month-by-month structure for easy reference. What happens if I miss a federal filing or payment deadline? Missing a deadline can lead to:

In some cases — such as BOI/UBO reporting — fines can reach $10,000. Using a compliance calendar or outsourcing to Confido eliminates these risks. Which forms do S-Corps, C-Corps, and LLCs need to file in 2026? S-Corporations:

C-Corporations:

LLCs:

All may require:

What are estimated tax payment deadlines for 2026? For individuals, LLC members, partners, and S-Corp shareholders:

C-Corps follow similar quarterly cycles depending on the fiscal year. Does this calendar include state-level compliance dates? No — this guide focuses only on federal deadlines. State deadlines vary by jurisdiction and entity type. Common state filings not covered here include:

If you want a State Compliance Calendar 2026, Confido can prepare one for your state(s) on request. How can small businesses automate compliance tracking? Small businesses can automate deadlines through:

For full automation, Confido manages:

You receive reminders + filings done for you. Can Confido handle tax filing and reminders for me? Absolutely. Confido provides complete compliance management including:

If you want zero compliance stress in 2026, Confido handles every federal filing from January to December.

|

Download Your 2026 Compliance Calendar & Stay Ahead with ConfidoFederal compliance isn’t something you can “figure out later.” Between payroll filings, quarterly estimated taxes, corporate deadlines, information returns, and BOI reporting, even one missed date can trigger penalties, notices, or unnecessary stress. But with the right calendar, the right bookkeeping systems, and the right partner, staying compliant becomes effortless. This 2026 Compliance Calendar gives you:

It’s your blueprint for staying organized and penalty-free throughout the year. Now, take the next step. 📥 Download the U.S. Compliance Calendar 2026 – PDF VersionGet a clean, printable version of the full calendar — perfect for your finance team, CPA, or internal operations workflow.

Partner With Confido for Zero-Stress Compliance in 2026Confido handles bookkeeping, payroll, tax deadlines, and compliance filings end-to-end — so you never worry about penalties or missed reports again. Whether you’re an early-stage startup, a fast-growing small business, or an international founder entering the U.S. market, we ensure your finances and filings stay accurate, organized, and IRS-ready. 👉 Let’s make 2026 your most organized financial year ever.

|