Year-End Bookkeeping Checklist for Small Businesses: 10 Essential Steps to Close Your Books

Introduction – Why Year-End Bookkeeping Matters for Small BusinessesAs a small business owner, your goal at year-end is simple: a clear, reliable, step-by-step checklist to close your books and prepare for tax filing. You want peace of mind that nothing has been missed, no receipt overlooked, and no deadline forgotten. The truth is, year-end bookkeeping isn’t just about tidying up spreadsheets—it’s about protecting your business, avoiding costly IRS penalties, and setting yourself up for a stronger new year. When the books are in order:

But without a proper checklist, many small businesses face the opposite reality: long nights reconciling QuickBooks, missed deductions, or worse—letters from the IRS. That’s why we’ve put together this complete year-end bookkeeping checklist, designed specifically for U.S. startups and SMEs. By following these steps, you’ll close your year on solid ground! And if it still feels overwhelming, outsourcing year-end bookkeeping to a trusted partner like Confido ensures everything is handled with accuracy and compliance built in. |

👉 Want expert support to get year-end bookkeeping off your plate? Get in touch with Confido and let us prepare your books so you can enter the new year stress-free.

Step 1: Reconcile Bank & Credit Card Accounts – Match Records to StatementsThe first step in any year-end bookkeeping checklist is reconciliation—matching your financial records to your bank and credit card statements. Think of it as the foundation: if this isn’t right, everything else you do (taxes, reporting, planning) will rest on shaky ground. Why Reconciliation Matters

How to Reconcile Accounts at Year-End

Confido’s Pro TipIf you use cloud bookkeeping solutions like QuickBooks Online, many bank feeds automatically import transactions. But automation isn’t foolproof—you still need a year-end reconciliation to catch errors or missing entries. |

👉 Reconciling accounts takes time and accuracy. Get in touch with Confido and let our experts handle your year-end reconciliations with precision.

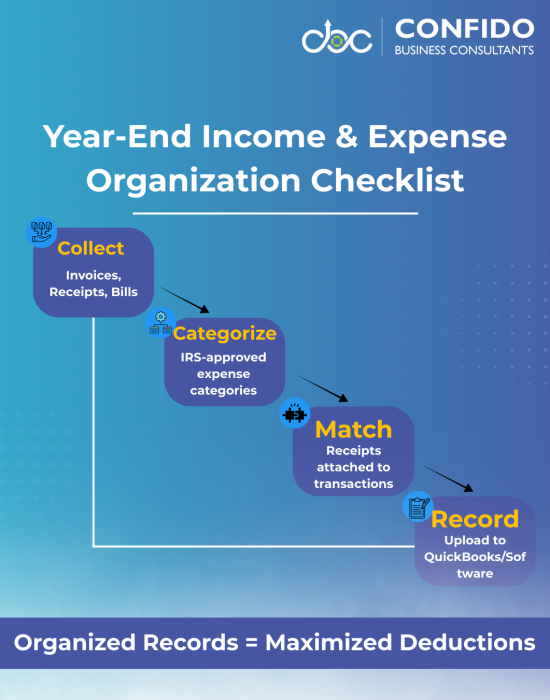

Step 2: Organize Income & Expense Records – Categorize Properly, Check ReceiptsOnce accounts are reconciled, the next crucial task is to organize all income and expense records. Proper categorization is what makes your Profit & Loss statement accurate, your tax deductions maximized, and your compliance headache-free. Why Organization Matters

How to Organize Income & Expenses at Year-End

Confido’s Pro TipThe IRS allows electronic copies of receipts—no need to keep shoeboxes of paper. Using cloud bookkeeping solutions, you can scan or upload receipts directly into your accounting software. This creates a digital audit trail that saves enormous time during tax filing. |

👉 Don’t risk missing deductions or misclassifying expenses. Get in touch with Confido and let us organize your income and expenses so you enter tax season with confidence.

Step 3: Review Accounts Receivable & Payables – Collect Outstanding Invoices, Clear Vendor BalancesYear-end is the perfect time to take stock of what’s owed to you and what you owe to others. This step ensures you’re not leaving cash on the table and that your liabilities are cleared before starting fresh in the new year.

Accounts Receivable: Collect What’s OwedOutstanding invoices can distort your year-end financial picture. Unpaid customer bills reduce cash flow and complicate your taxes.

Accounts Payable: Clear Your BalancesOn the flip side, review what you owe to vendors and suppliers:

Confido’s Pro TipClearing A/P not only improves vendor trust but also gives you cleaner books—your liabilities are updated, and your Profit & Loss reflects true expenses for the year. |

👉 Don’t let unpaid invoices or vendor debts carry over into the new year. Get in touch with Confido and let us reconcile your receivables and payables before year-end.

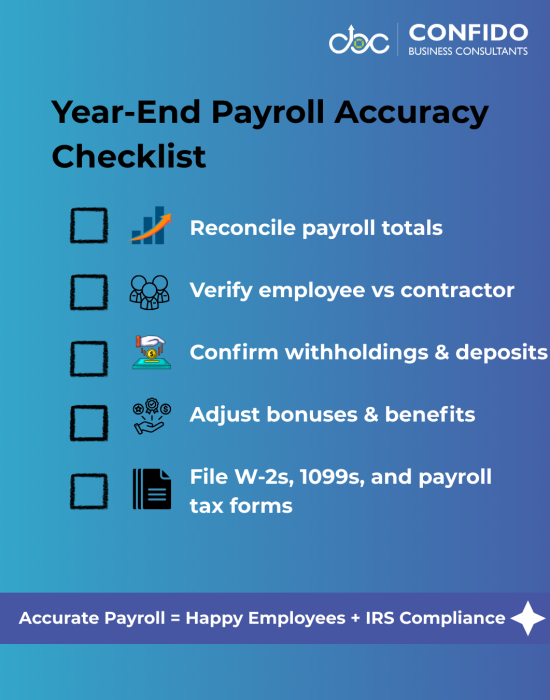

Step 4: Verify Payroll Records – Ensure Accurate Wages, Withholdings, and FilingsPayroll is one of the most critical areas of year-end bookkeeping. It’s also one of the most scrutinized by the IRS and state agencies. Errors in payroll—whether in wages, taxes, or filings—can result in penalties, unhappy employees, and messy books heading into the new year.

Why Payroll Accuracy Matters

Steps to Verify Payroll at Year-End

Confido’s Pro TipIf you use QuickBooks Payroll or another cloud system, much of this process is automated. But always run a year-end audit to catch errors before filings go out—it’s easier to correct now than mid-tax season. |

👉 Payroll mistakes are costly and stressful. Get in touch with Confido and let us handle your year-end payroll reconciliation and filings.

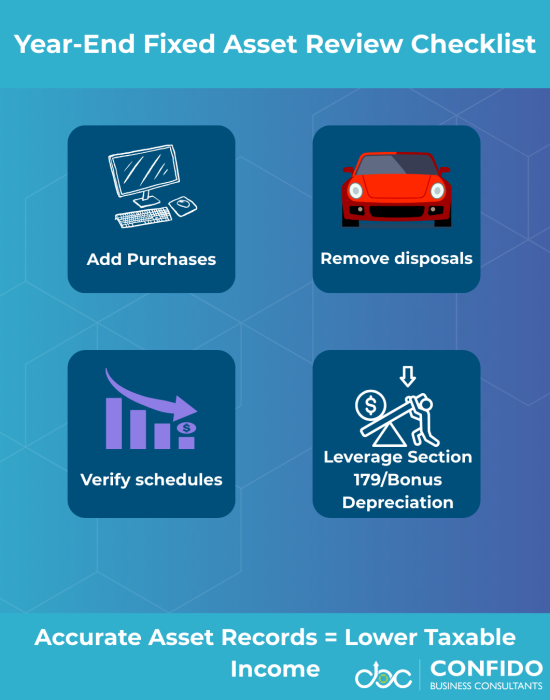

Step 5: Review Fixed Assets & Depreciation – Update Asset Register, Depreciation SchedulesFixed assets—like equipment, vehicles, and property—play a big role in both your financial reports and your tax strategy. At year-end, it’s essential to review your asset register and ensure depreciation is properly accounted for.

Why Fixed Asset Review Matters

How to Review Fixed Assets at Year-End

Pro TipMany small businesses overlook this step, but proper asset tracking can significantly reduce taxable income. If you’ve invested in new equipment, vehicles, or technology this year, consult your bookkeeper or CPA to ensure you’re capturing all available deductions. |

👉 Don’t miss out on valuable depreciation deductions. Talk to us and let our team review your fixed assets before you close the year.

Step 6: Count and Value Inventory – Physical Counts, AdjustmentsFor product-based businesses, year-end inventory isn’t just a compliance task—it’s the backbone of accurate financial reporting. An incorrect inventory balance can distort both your profit margins and your taxable income.

Why Inventory Counts Matter

How to Count and Value Inventory at Year-End

Confido’s Pro TipEven service-based businesses should double-check if they carry small amounts of materials or supplies—they may count as inventory for tax purposes. |

👉 Inventory errors can cost you profits and increase your tax bill. Talk to our team at Confido and let us streamline your year-end inventory process.

Step 7: Check Compliance Deadlines – IRS Filing, State Taxes, Payroll FormsYear-end bookkeeping isn’t complete without a thorough review of compliance deadlines. Missing just one filing or payment can trigger costly penalties and interest charges. For small businesses with tight margins, these fines can be especially painful.

Why Compliance Deadlines Matter

Key Year-End Compliance Deadlines to Track

Confido’s Pro TipSet up a compliance calendar that includes federal and state deadlines. Cloud bookkeeping solutions like QuickBooks Payroll can automate reminders—but always verify dates with your CPA or bookkeeper to avoid surprises. |

👉 Deadlines don’t have to keep you up at night. Schedule a call with Confido and let us manage your compliance calendar so you never miss a filing.

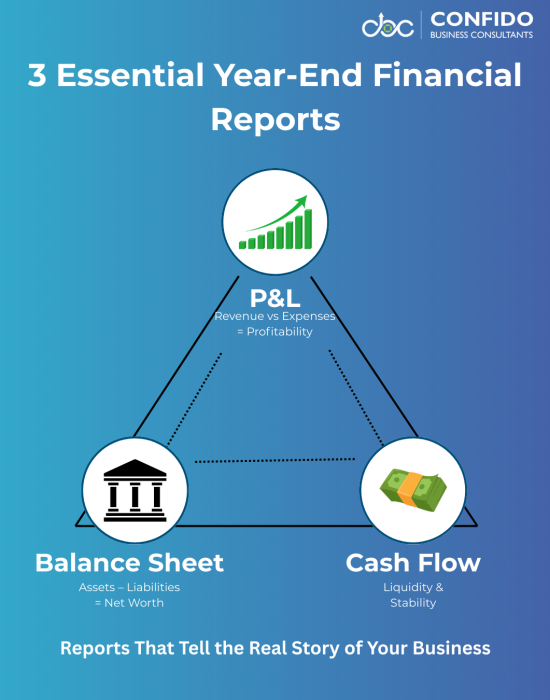

Step 8: Review Financial Reports – P&L, Balance Sheet, Cash FlowOnce your records are reconciled, expenses organized, and compliance checked, it’s time to step back and look at the big picture. Your year-end financial reports provide a snapshot of how your business performed—and guide smarter decisions for the year ahead.

Key Financial Reports to Review

Why This Review Matters

Confido’s Pro TipDon’t just glance at reports—compare them year over year. Trends tell the real story. For example, if revenue is growing but profit margins are shrinking, it may signal rising overheads or pricing issues. |

👉 Numbers don’t just tell you where you’ve been—they guide where you’re going. Talk to Confido’s experts to review your year-end financial reports and plan your next moves with clarity.

Step 9: Plan for Taxes – Identify Deductions, Credits, Work with Your CPAYear-end is your last opportunity to optimize taxes before filing season. Instead of waiting until April and hoping for the best, smart businesses use this time to plan deductions, capture credits, and work with their CPA to minimize tax liabilities.

Identify Tax DeductionsReview your categorized expenses (from Step 2) to ensure all possible deductions are captured:

Even small expenses add up—missing them means you pay more tax than necessary.

Explore Tax CreditsCredits directly reduce your tax bill, and small businesses often overlook them:

These can provide significant savings if planned before filing.

Work with Your CPA or Bookkeeping PartnerYear-end is when collaboration pays off:

Confido’s Pro TipDon’t wait until April to hand over receipts. By planning now, you maximize deductions and credits, reduce stress, and start the new year financially prepared. |

👉 Year-end tax planning can be overwhelming, but you don’t have to do it alone. Book a consultation with Confido and let us help you identify deductions, capture credits, and minimize your tax bill.

Step 10: Set Goals for the New Year – Use Insights to Plan Budgets/ForecastsYear-end bookkeeping isn’t just about closing the books—it’s also about opening doors. With reconciled accounts, organized expenses, and accurate reports, you now have a financial mirror showing exactly how your business performed. The next step? Using those insights to set clear goals and budgets for the year ahead.

Why Goal-Setting Matters

How to Set Financial Goals for the New Year

Confido’s Pro TipDon’t just set goals—schedule quarterly reviews to measure progress. Small course corrections throughout the year are far more effective than big adjustments at year-end. |

👉 Start the new year with a plan, not just a resolution. Talk to Confido about creating budgets and forecasts that set your business up for sustainable growth.

Frequently Asked Questions About Year-End Bookkeeping

Why is year-end bookkeeping important for small businesses?

Year-end bookkeeping ensures your financial records are accurate, tax-ready, and compliant. It helps you avoid penalties, maximize deductions, and start the new year with clarity on cash flow, expenses, and profitability.

What should be included in a year-end bookkeeping checklist?

A comprehensive checklist covers reconciliation of bank and credit card accounts, organizing income and expenses, reviewing receivables and payables, verifying payroll, updating assets and depreciation, counting inventory, checking compliance deadlines, reviewing financial reports, tax planning, and setting goals for the new year.

How do I prepare my books for tax season?

Start by reconciling accounts, organizing receipts, and ensuring payroll and compliance filings are accurate. Generate financial reports (P&L, Balance Sheet, Cash Flow) and review them with your CPA or bookkeeping partner. Proper preparation means less stress and fewer surprises come tax filing time.

Can QuickBooks help with year-end bookkeeping?

Yes. QuickBooks Online is one of the most widely used tools for small businesses. It can automate transaction imports, categorize expenses, attach digital receipts, and generate reports. However, you’ll still need to review, reconcile, and ensure accuracy before filing taxes.

Should I outsource year-end bookkeeping tasks?

Outsourcing year-end bookkeeping can save time, reduce errors, and ensure compliance. Instead of spending long nights reconciling records, small businesses can rely on experts to handle the process and focus on growth.

What happens if I don’t reconcile accounts before year-end?

Unreconciled accounts can distort your financial statements, inflate or understate your taxable income, and trigger IRS red flags. Worse, you may overpay or underpay taxes. Reconciling accounts is the foundation of accurate year-end reporting.

Conclusion: Close the Year with ConfidenceYear-end bookkeeping doesn’t have to be overwhelming. With a clear checklist in hand, you can reconcile accounts, organize expenses, review reports, and plan for taxes with confidence. The payoff is huge:

But let’s be honest—doing all this on your own can drain valuable time and energy. That’s why more and more small businesses are turning to outsourced bookkeeping solutions. By partnering with experts, you get the accuracy, compliance, and peace of mind you need—while staying free to focus on growth. At Confido, we specialize in helping U.S. small businesses and international founders simplify year-end bookkeeping. From reconciliations to compliance deadlines, our team makes sure nothing slips through the cracks. |